Real Estate Income Trusts or REITs are known to be retirees’ best friends. Why? Because they share several key factors for income-seeking investors. Notably, Canadian REITs are known for the following:

- Their generous dividend yield (may offer a yield over 3%)

- Many pay their distribution monthly (fits well with your budget!)

- REITs operate stable businesses (recession-proof!)

- Their goal is to distribute as much money as possible (isn’t what you are looking for?)

- They are an excellent inflation hedge! (most of them have contracts with escalators clauses).

Before we jump to the Best Canadian REITs

While REITs are great to generate income at retirement, they can’t be analyzed using the same metrics as dividend stocks. For example, REITs don’t pay dividends, they pay a distribution that could be a mix of dividend, return of capital, and income. Therefore, REITs distributions are not eligible for the tax credit! Don’t worry, if you invest in a registered account such as an RRSP or a TFSA, you’re all good.

Besides their distribution, there are other characteristics that make REITs a unique investment type. Here are a few of them.

REITs valuation

Valuing a REIT is like valuing any stock. I generally use the Dividend Discount Model, since most of their profits are paid as dividends.

There are, however, a few key metrics to know.

Net Asset Value (NAV) is another estimate of intrinsic value. It’s the estimated market value of the portfolio of properties, and it can be determined by using a capitalization rate on the current income that is fair for those types of properties. This can potentially understate the value of the properties because properties may appreciate rather than depreciate over time. Compare the NAV to the price of the REIT.

Funds from Operations (FFO & AFFO)

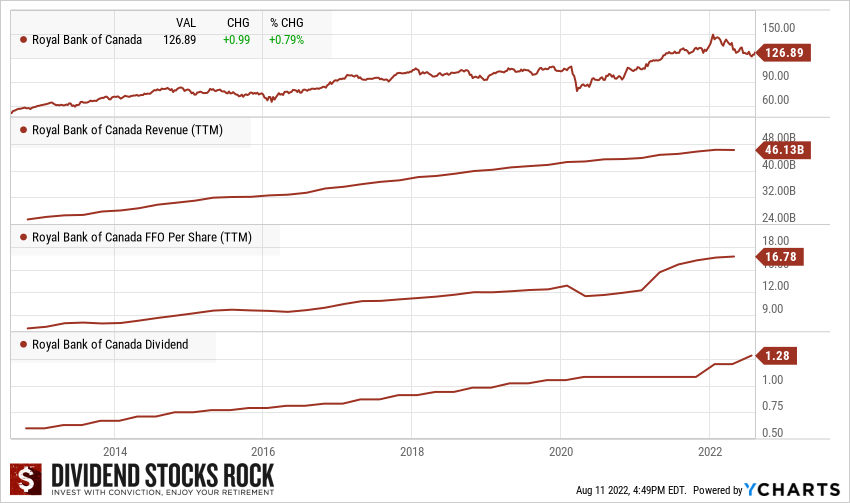

The Funds from Operations (FFO) are far more important than net income for a REIT. To determine net income, depreciation is subtracted from revenues. Since depreciation is a non-cash item, it might not represent a true change in the value of the company’s assets. FFO calculation adds back depreciation to net income to provide a better idea of what the cash income is for a REIT.

Adjusted Funds from Operation (AFFO) is arguably the most accurate form of income measurement of all regarding REITs since it takes FFO but then subtracts recurring capital expenditures on maintenance and improvements. It is a non-GAAP measure, but a very good measure for the actual profitability and the actual amount of cash flow that is available to pay out in dividends.

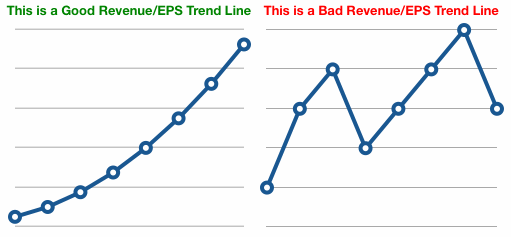

So rather than look to Earning per Share (EPS), which is calculated using net income, for REITs, look for the FFO per unit or AFFO per unit.

Overall, it is good to look for REITs that have diversified properties, strong FFO and AFFO, and a good history of consistent dividend growth.

Top 3 Largest Canadian REITs

One way to classify REITs is by market cap. Many investors feel more comfortable selecting a well-diversified business with a large property portfolio. Some REITs are present in many cities and provinces providing optimal geographic diversification. Here are the three largest Canadian REITs:

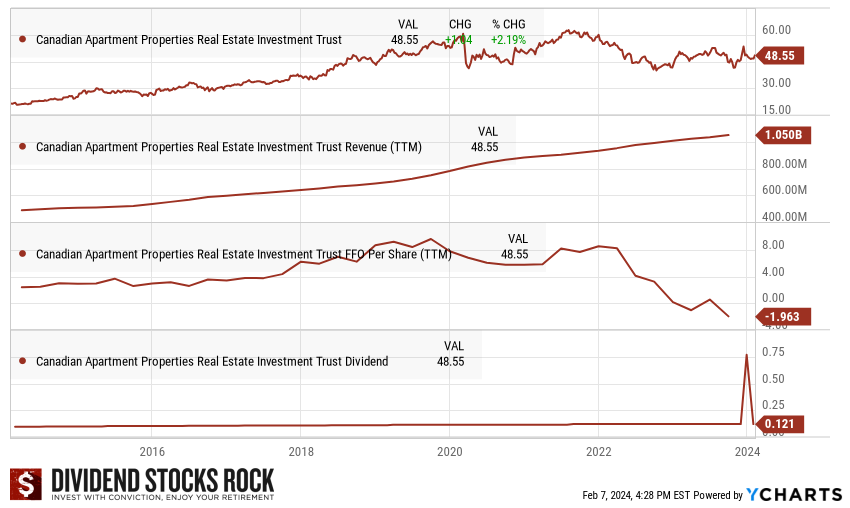

Canadian Apartment Properties REIT (CAR.UN.TO)

- Market Cap: 8B

- Dividend Yield: 3.06%

- Sub-Sector: Residential

If an investor is looking for a steady source of income that will keep up with inflation, CAPREIT should be on their watchlist. In addition to enjoying a strong core business in Canada, CAPREIT is expanding its business in Ireland and the Netherlands. This gives them additional geographic diversification. CAPREIT continues to exhibit high-single-digit organic growth while raising additional funds to acquire more buildings. Unfortunately, the REIT neglected to increase its dividend in 2020. We cannot blame management for being overly cautious over the pandemic; they were fortunately stronger in 2021 and won back their dividend safety score of 3.

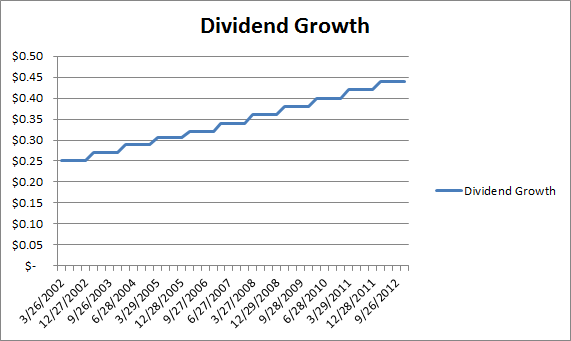

Dividend Growth Perspective

Over the past 5 years, management has been able to steadily increase its monthly distribution. The REIT continued its dividend growth tradition with a modest increase in 2019 (+3.6%). Management has proven its ability to grow its revenue both organically and through acquisitions. After taking a pause in 2020, CAPREIT came back with a generous dividend increase (+5.2%) from $0.115 per share to $0.121 per share earlier in 2021. The REIT won back its dividend safety score of 3 as it exhibits a strong FFO payout ratio of 62.6% for the full year of 2021. You can expect another dividend increase in 2022! The recent stock price drop brought the yield to about 3%; this looks like a good deal if you are prepared to be patient (e.g., expect more volatility throughout the rest of the year).

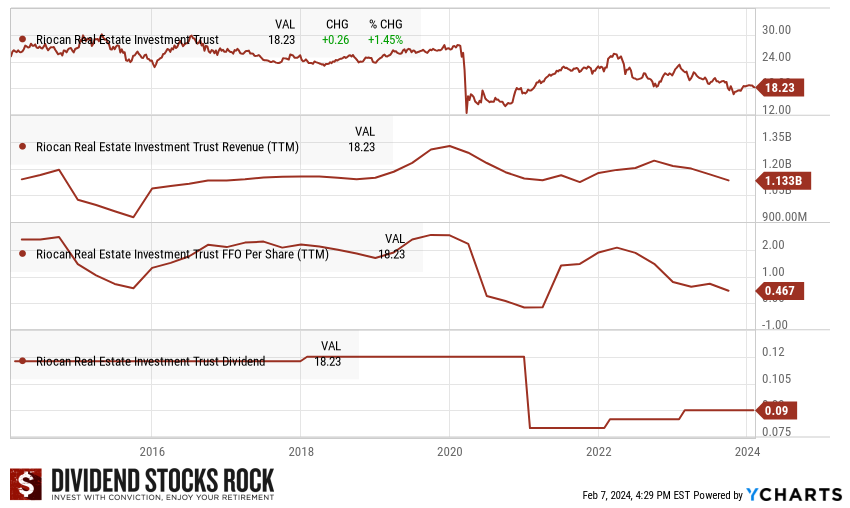

RioCan REIT (REI.UN.TO)

- Market Cap: 5.5B

- Dividend Yield: 5.9%

- Sub-Sector: Retail

The REIT boasts an impressive occupancy rate. Over the past couple of years, REI sold non-core assets to concentrate on what they know best. We like management’s new focus, and we think it will help build additional value for investors into the future. RioCan can count on solid growth going forward, with 90% of its rents coming from the top 6 markets in Canada (with roughly 50% coming from the Greater Toronto Area).

Unfortunately, the REIT must face constant headwinds coming from the retail brick & mortar industry. For this reason, RioCan is pursuing residential urban development projects (80%+ of its current pipeline). This could be an interesting growth direction, but we wonder: will it be enough to compensate for the brick & mortar retail industry’s slowdown? In the meantime, REI increased its FFO per unit by 7% for the full year of 2022 and it has several projects in its pipeline. We see continuity in FFO per unit growth in 2023. The REIT exhibits a strong balance sheet and a low payout ratio.

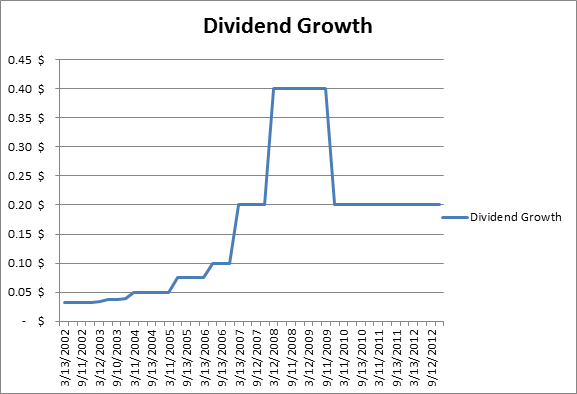

Dividend Growth Perspective

An investor shouldn’t expect much in terms of short-term dividend growth. When calculated using the DDM, we used a 3% dividend growth rate now that the REIT freed up some cash flow and increased its distribution by 6.25% in 2021. Let’s hope that their plans to expand into offices and apartment buildings will be profitable. The FFO payout ratio will be in line, but we expect RioCan to be more prudent with its cash flow. As expected, the REIT offered a dividend increase in 2023 (+5.88% from $0.085/share to $0.09/share).

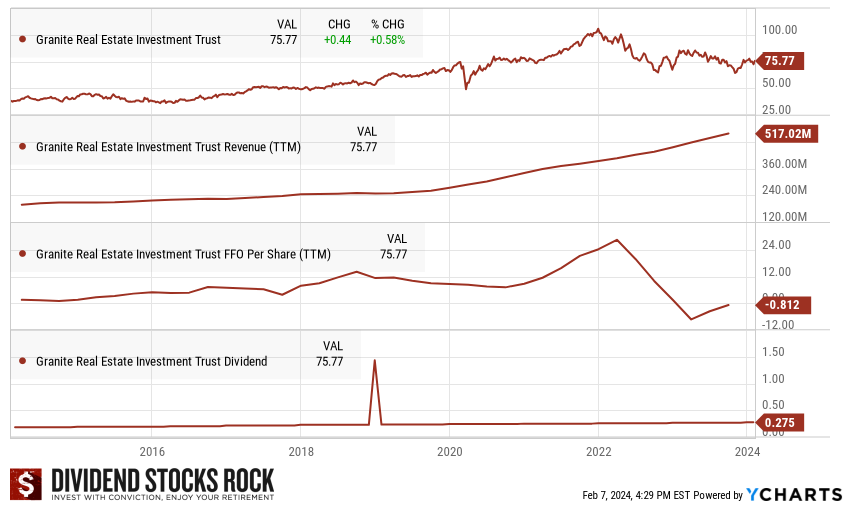

Granite REIT (GRT.UN.TO)

- Market Cap: 4.8B

- Dividend Yield: 4.41%

- Sub-Sector: Industrial

GRT used to be an extension of Magna International (MG.TO). In 2011, Magna represented about 98% of its revenues. It is now down to 25% as of November 2023 (with Amazon as its second-largest tenant with 4% of revenue). You’ll notice that each year, GRT reduces its exposure by a few percentage points. Management has transformed this industrial REIT into a well-diversified business without adversely affecting shareholders. GRT now manages 138 properties across 7 countries. Each time we review this stock card, the number of properties increases while the exposure to Magna Intl reduces. The REIT also boasts an investment grade rating of BBB/BAA2 stable. With a low FFO payout ratio (around 70-75%), shareholders can enjoy a 5% yield that should grow and match or beat the inflation rate. This is among the rare REITs exhibiting AFFO per unit growth while issuing more units to finance growth.

Dividend Growth Perspective

GRT has maintained a solid dividend growth policy over the past 5 years (4%+ CAGR). With its FFO payout ratio well under control shareholders should expect a mid single-digit dividend growth rate going forward. The AFFO payout ratio was under 73% for Q3 2023 (reported in November 2023). You can expect more distribution increases going forward! The company even paid a special dividend in 2019. If the Magna International business is doing well, GRT will perform and keep increasing its dividend. The REIT offered a conservative distribution increase in November of 2023 with a raise of 3.125%.

We issued a buy rating on Granite a while ago. Even with the stock price bouncing back a bit, it’s still a buy.

Highest Yield REITs

If you are retired, your main concern may be how much income your portfolio can generate. In this case, you may be interested in finding out the most generous REITs. A word of caution, a very high yield isn’t necessarily a sign that all is great, always make you due diligence when researching REITs to choose the best and safest. More information about that later in this post.

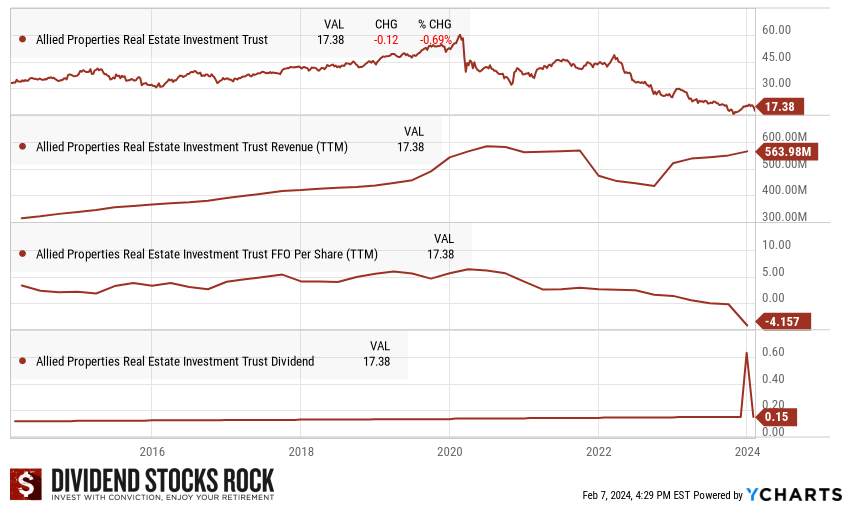

Allied Properties REIT (AP.UN.TO)

Allied Properties REIT (AP.UN.TO)

- Market Cap: $2B

- Dividend Yield:10.29%

- Sub-Sector: Office

Allied features one of the strongest balance sheets among Canadian REITs. It has much of its capital invested in low-cost projects and is currently paying down higher-interest debt at the same time as investing in new projects. AP maintains its unique expertise in managing and developing prime heritage locations, which will continue to be in high demand in the coming years. The REIT also counts on many technology clients, which represent a growing sector in Canada. There are still concerns surrounding office REITs (AP generates ~70% of its income from offices), but this REIT has proven its resilience in difficult times. The 2023 distribution increase (+2.7% in early 2023) and low payout ratio for a REIT are good signs. AP will sell its data centers to bank highly valued assets in order to purchase more undervalued ones (office properties). This could be a very strong move. However, AP remains a high-risk, high-reward play, but please proceed with caution.

Dividend Growth Perspective

In evaluating a REIT, we hope that the dividend increase will at least match inflation. This is the case with AP. The company has posted a 2.5% dividend CAGR over the past 5 years and exhibits healthy FFO and AFFO growth. An investor can therefore, expect 2-3% annual dividend growth going forward. For the full year of 2022, the REIT exhibits an AFFO payout ratio of 81%. Allied increased its distribution by 2.7% in 2023 (after a 3% increase in 2022), bringing its annual distribution payment to $1.80/share. This demonstrates strong confidence from management and pleasant news for shareholders! However, it doesn’t mean it’s a smart move…

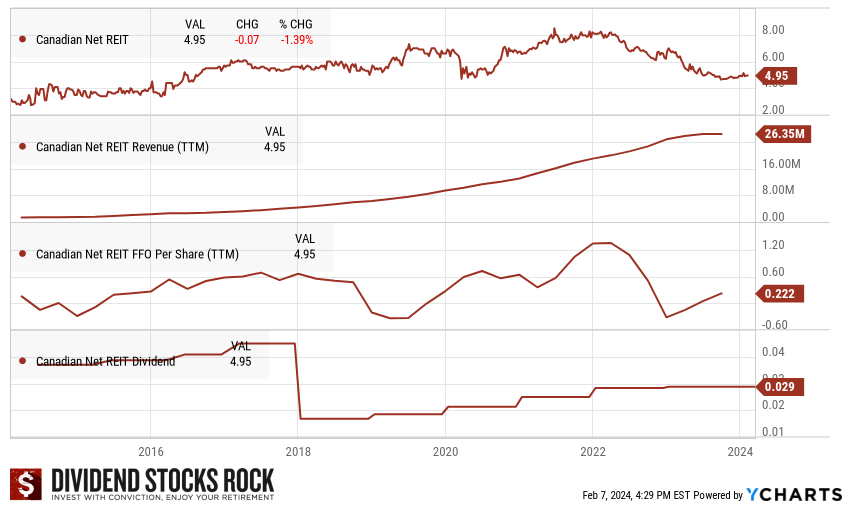

Canadian Net REIT (NET.UN.V)

Canadian Net REIT (NET.UN.V)

- Market Cap: $102.7M

- Dividend Yield:6.87%

- Sub-Sector: Diversified

This is an interesting small REIT that has flown under the radar. Canadian Net REIT enjoys stable cash flows from its properties under the triple net lease formula (tenants handle insurance, taxes, and maintenance costs). Triple net lease REITs let tenants manage more risk as they handle all expenses involving the property. The REIT has high quality tenants such as Loblaws (25% of NOI), Walmart (11%), Sobeys (10%), Suncor (7%) and Tim Hortons (6%). The REIT’s portfolio makes this company quite resilient to any kind of recession. The bulk of its properties are situated in the province of Quebec, with a small number in Ontario and the Maritimes. We should keep in mind that the company trades on the TSX Venture. This small cap (approximately $100M of market capitalization) is subject to low trading volume and strong price fluctuations. Monitor this one quarterly to make sure the situation remains stable. Always proceed with caution with small caps.

Dividend Growth Perspective

Don’t be alarmed by the dividend drop in 2018, as the REIT simply changed its payment schedule. In fact, this small cap has been continually increasing its dividend since its IPO in 2011. The FFO payout ratio hovers between 55% and 65% as their FFO per unit grew just as quickly as its dividend in the past decade (in fact, it grew even faster). Unfortunately, while management claims the distribution is safe with a payout ratio of 62%, it didn’t announce an increase. Following the small increase of 2023 (+3.6%) and no increase for 2024, the REIT is likely going to lose its dividend safety score of 3 if it doesn’t increase its distribution later in 2024. Revenue increased through higher rental income, but higher interest charges affected the FFO. Proceed with caution with this small cap.

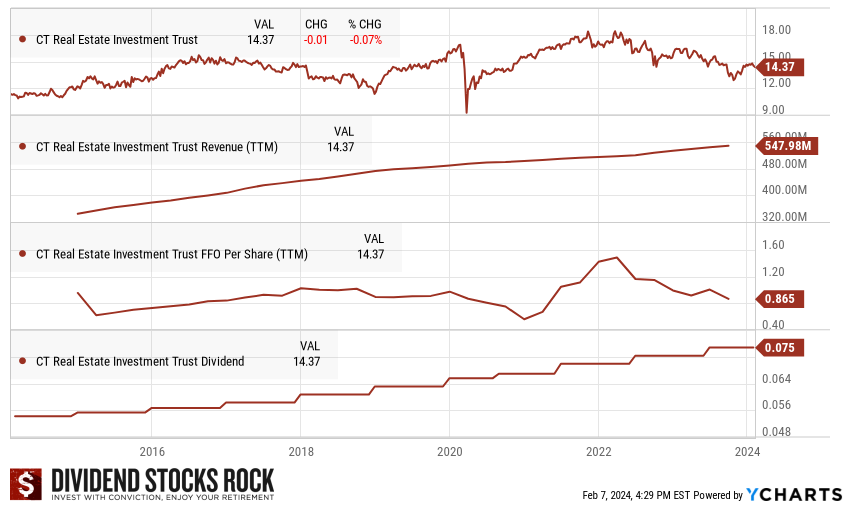

CT REIT (CRT.UN.TO)

- Market Cap: 2BM

- Dividend Yield:6.25%

- Sub-Sector: Retail

An investment in CT REIT is primarily an investment in Canadian Tire’s real estate business. If you think this Canadian retail giant will do well in the future, but you are more interested in dividends than pure growth, CT REIT could be a good fit for you. Canadian Tire has exciting growth plans that will eventually lead to more triple-net leases for CT REIT. The fact that CRT pays a monthly dividend with a 6% yield is highly attractive to income-seeking investors. On top of that, CT REIT exhibits a decent dividend growth rate policy, matching and beating inflation over the long haul. In the past 10 years, the company grew its revenue and AFFO by mid-single digits numbers. This makes it a perfect candidate for an income-focused portfolio. Canadian Tire has done well in the past 5 years thus far and has proven the resilience of its business model. It’s a sleep well at night REIT that should please all income-seeking investors.

Dividend Growth Perspective

This REIT continues to grow and maintain a low AFFO payout ratio of 75% for full year 2022. The AFFO payout ratio for the first nine months of 2023 is at 73.2% (slightly below 2022 numbers). This means your distribution will likely continue to increase faster than the inflation rate going forward. Shareholders can expect to cash in a solid 6% yield with a ~3% growth rate. This is a perfect example of a sleep-well-at-night type of holding. After a small increase in 2020 (+1.5%), CT REIT came back strong with increases of 4.5% and 3.3% in 2021 and 2022, respectively. Keep in mind that many retail REITs cut their dividend over the pandemic. CT REIT has proven that an investor can trust the company to be part of their retirement plan. CT REIT rewarded investors with another 3.5% distribution increase in 2023. Even with a conservative DDM calculation (expected dividend growth of 3%), the REIT offers an attractive entry point at a price below $15.

My Favorites

Finding the perfect REITs isn’t easy. As a dividend growth investor, I look for a combination of a stable business with some growth perspective. I like when management can grow their property portfolio through investments and acquisitions while increasing distributions enough to beat inflation. I found this perfect balance among these three Canadian companies, which happen to be either among the largest or the highest-yield REITs we covered earlier in this post:

Granite REIT (GRT.UN.TO)(GRP.U)

CT Real Estate Investment Trust (CRT.UN.TO)

Canadian Apartment Properties REIT (CAR.UN.TO)

Learn how to invest in REITs

Unfortunately, not all REITs are created equal and you must do adequate research to make sure you buy the right ones.

Watch this webinar, in which I answer questions like:

- How about REITs paying a 10% yield

- How to make sure the REIT’s distribution is safe

- Which metrics to consider during my analysis?

- Should I consider mortgage REITs?