We look at the Canadian Dividend Aristocrats for 2025, what they are, who they are, and why they matter to dividend growth investors. See some of our favorite aristocrats and why we like them, and learn where to find stocks that are right for you.

What’s a Canadian Dividend Aristocrat?

It’s a Canadian company showing five consecutive years with a dividend increase. Aristocrats are solid companies with a robust balance sheet.

Why do they matter to you?

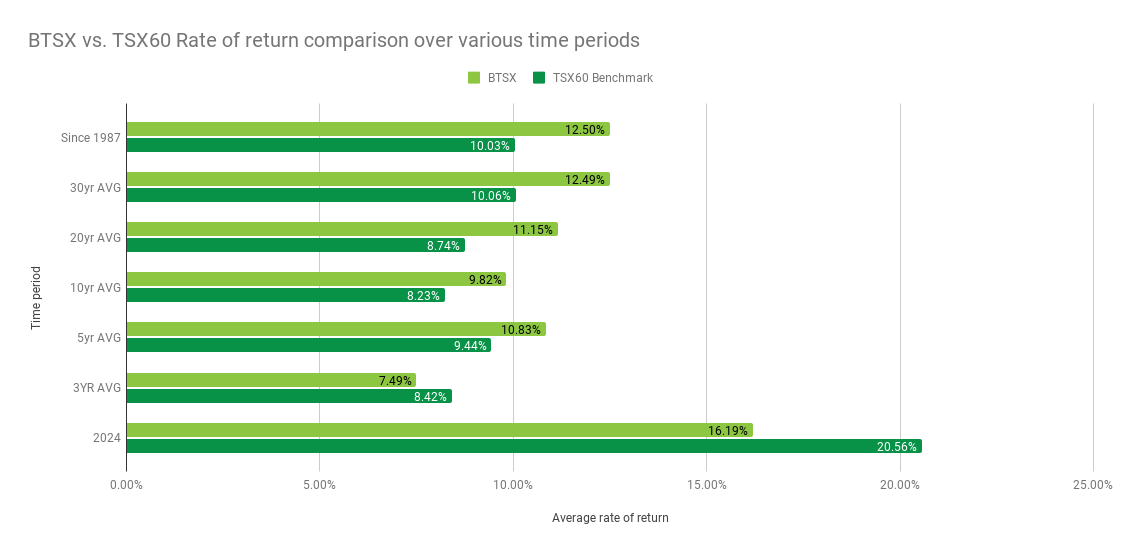

Dividend growers tend to outperform the market over a long period, and with less volatility. Dividend growers = more money and less stress. Investing in Canadian dividend growers should lead to recurrent investment income and help you achieve your retirement goals.

Can you invest in any Canadian Dividend Aristocrat and make money?

NO. This guide to Canadian Dividend Aristocrats provides you with a list of stocks and a methodology to select the right companies for your portfolio. We also share our favorite Canadian aristocrats.

Canadian Aristocrats and U.S. Aristocrats

The Canadian Dividend Aristocrats list is the little brother of a much more extensive and world-known dividend growers list. The popular U.S. Dividend Aristocrats List includes companies with over 25 consecutive years of dividend increases. What about Canadians? Do we have companies showing 25+ years of consecutive dividend increases?

While Canada has a few companies that achieved that feat, the Canadian Dividend Aristocrats list would be too short if we included them using the US requirement. Canadian aristocrats are companies that increased their dividends for at least five consecutive years.

While many investors might think 5 years is insufficient to give such an elite title to a company, I disagree. I love picking stocks that have just started increasing their dividends on their way to a great future. It’s a unique opportunity to select high-quality companies and enjoy stock price appreciation. We all wish we had bought shares of Coca-Cola (KO) 50 years ago when it was a young dividend grower. You have a similar opportunity with the Canadian dividend aristocrats.

Skip to the Good Stuff: Canadian Rock Stars List

Don’t get me wrong, I like the Canadian Aristocrats and will share more about them below. However, I believe there’s a better way to select dividend growers that will thrive for decades.

I have created a list showing about 300 companies with growing revenue, earnings per share (EPS), and dividend growth trends. Focusing on trends rather than numbers gives you a better perspective on past, present, and future growth.

The Dividend Rock Stars List is the best place to start your stock research. Get it for free by entering your name and email below.

What it Takes to Become a Canadian Dividend Aristocrat?

Canadian companies don’t have to show 25 years of consecutive dividend increases, unlike U.S. aristocrats. Even the 5-year minimum requirement isn’t as strict as you might think. The requirements Canadian companies must meet to earn the title are:

- The company’s common stock is listed on the Toronto Stock Exchange (TSX) and is a constituent of the S&P BMI Canada. Stocks listed on the TSX Venture aren’t eligible.

- The company’s market capitalization (Float-adjusted) is at least $300M. We want companies of a minimal size. Yet $300M is relatively permissive.

- The company increased its regular cash dividends for five consecutive years, but companies can pause their dividend growth policy for a maximum of 2 years within said 5-year. In other words, if the company intends to share the wealth, it has a good chance of being included among the elite dividend growers.

Needless to say, it’s easier to become a Canadian aristocrat than a U.S. aristocrat! To do that, U.S. companies must:

- Be a member of the S&P 500.

- Show 25+ consecutive years of dividend increases.

- Meet specific minimum size & liquidity requirements.

It would be foolish to think that any aristocrat out of the list makes a good investment. We regularly see companies added or withdrawn from the list on both sides of the border. The list you see in 2025 shows only those who survived the test of time.

Canadian Dividend Aristocrats for 2025

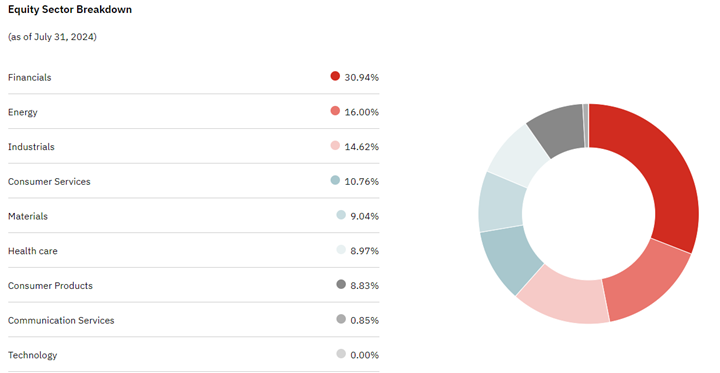

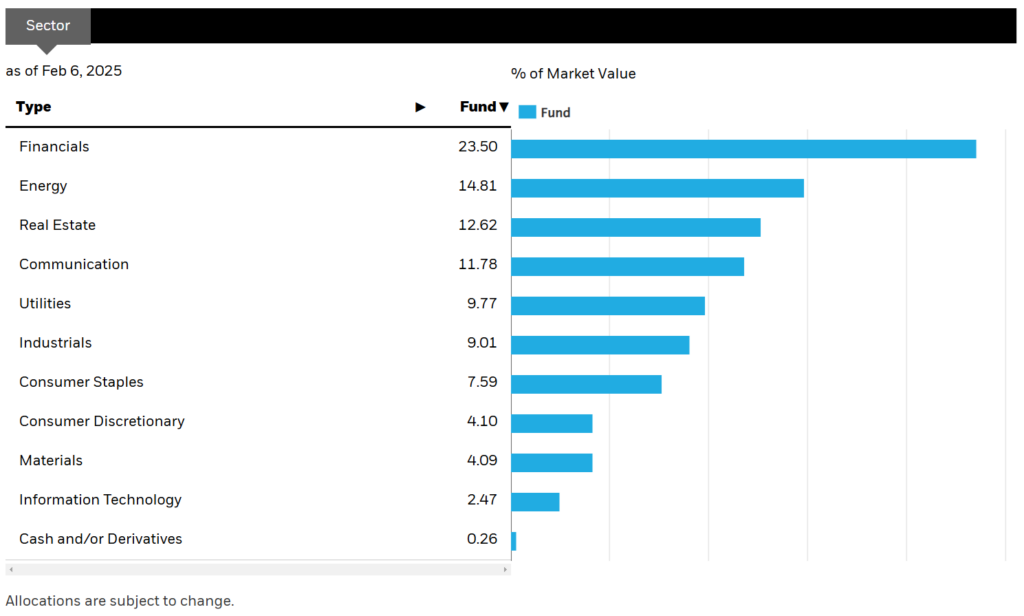

There are 92 Canadian dividend aristocrats in 2025. You’ll find very few Technology companies as that sector is not known for steady cash payments to shareholders. However, you’ll see many Financial Services and Industrials companies. Those two sectors have been and continue to be well-established dividend payers in Canada.

As shown below, half the Canadian dividend aristocrats are in the Financials, Industrials, and Real Estate sectors and about 22% are in the Communication Services and Utilities sectors. Industrials, Consumer Staples, Consumer Discretionary, and Materials each represent 4% to 9% of aristocrats. There are none in healthcare.

Here are the Canadian dividend aristocrats as of 2025, grouped by sector.

Core Sectors

Financials

| Bank of Montreal (BMO.TO) | Intact Financial (IFC.TO) |

| Brookfield Asset Management (BAM.TO) | Manulife (MFC.TO) |

| Brookfield Corp (BN.TO) | National Bank (NA.TO) |

| CIBC (CM.TO) | Power Corporation (POW.TO) |

| Equitable Group (EQB.TO) | Royal Bank (RY.TO) |

| Fiera Capital Corp (FSZ.TO) | ScotiaBank (BNS.TO) |

| First National Financial (FN.TO) | Sun Life Financial (SLF.TO) |

| Great West Life (GWO.TO) | TD Bank (TD.TO) |

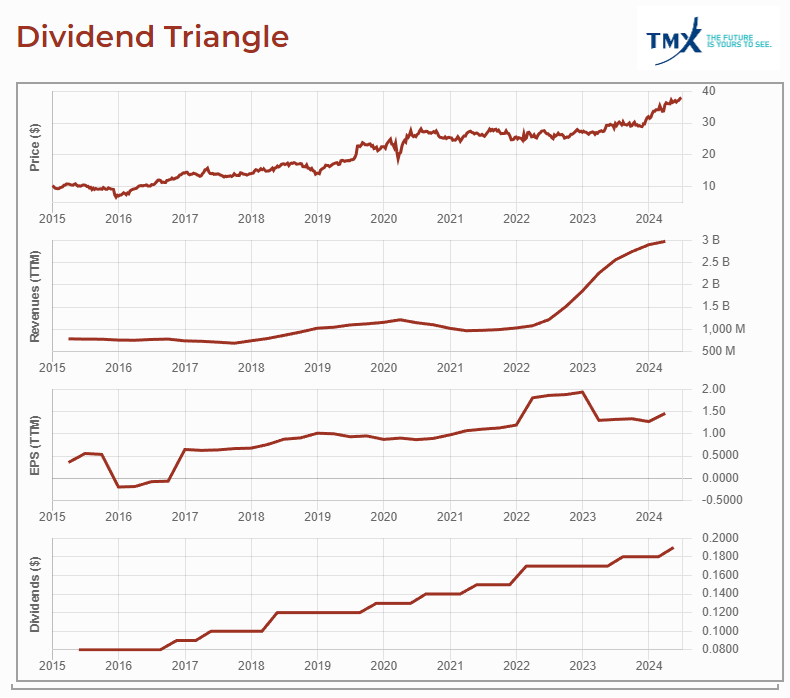

| Industrial Alliance (IAG.TO) | TMX Group (X.TO) |

Consumer Staples

| Alimentation Couche-Tard (ATD.TO) | Maple Leaf Foods (MFI.TO) |

| Empire Co (EMP.A.TO) | Metro (MRU.TO) |

| George Weston (WN.TO) | Premium Brands (PBH.TO) |

| Jamieson Wellness (JWEL.TO) | Saputo (SAP.TO) |

| Loblaw (L.TO) | The North West Company (NWC.TO) |

Information Technology

| Enghouse Systems (ENGH.TO) |

| Open Text Corporation (OTEX.TO) |

Growth Sectors

Industrials

| ADENTRA (ADEN.TO) | Hammond Power Solutions (HPS.A.TO) |

| Aecon Group (ARE.TO) | Savaria Corporation (SIS.TO) |

| Badger Daylighting (BDGI.TO) | Stantec (STN.TO) |

| Boyd Group Services (BYD.TO) | TFI International (TFII.TO) |

| Canadian National Railway (CNR.TO) | Thompson Reuters (TRI.TO) |

| Cargojet (CJT.TO) | Toromont Industries (TIH.TO) |

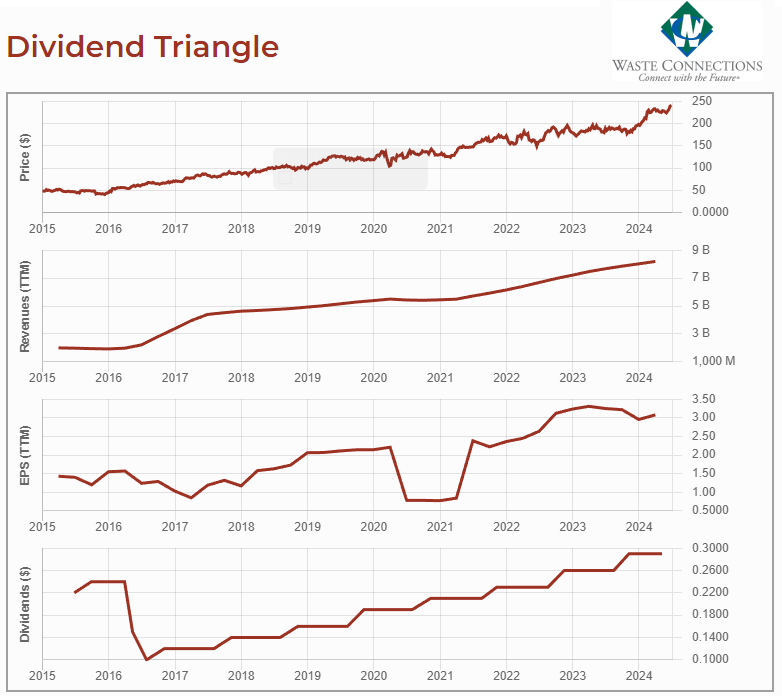

| Exchange Income Fund (EIF.TO) | Waste Connections (WCN.TO) |

| Finning Intl (FTT.TO) |

Consumer Discretionary

| Canadian Tire Corporation (CTC.A.TO) | Magna International (MG.TO) |

| Dollarama Inc (DOL.TO) | Restaurant Brands International (QSR.TO) |

Income sectors

Real Estate

| Allied Properties REIT (AP.UN.TO) | InterRent REIT (IIP.UN.TO) |

| Canadian Apartment Properties REIT (CAR.UN.TO) | Killam Apartment REIT (KMP.UN.TO) |

| CT REIT (CRT.UN.TO) | Minto Apartment REIT (MI.UN.TO) |

| FirstService Corp (FSV.TO) | Storagevault Canada (SVI.TO) |

| Granite REIT (GRT.UN.TO) |

Utilities

| AltaGas (ALA.TO) | Fortis (FTS.TO) |

| Atco (ACO.X.TO) | Hydro One (H.TO) |

| Canadian Utilities (CU.TO) | TransAlta Corp (TA.TO) |

| Emera (EMA.TO) |

Communication Services

| BCE (BCE.TO) | Quebecor (QBR.B.TO) |

| Cogeco (CGO.TO) | Telus (T.TO) |

| Cogeco Cable (CCA.TO) |

Volatile Sectors

Materials

| Altius Minerals (ALS.TO) | Stella-Jones (SJ.TO) |

| CCL Industries (CCL.B.TO) | West Fraser Timber (WFG.TO) |

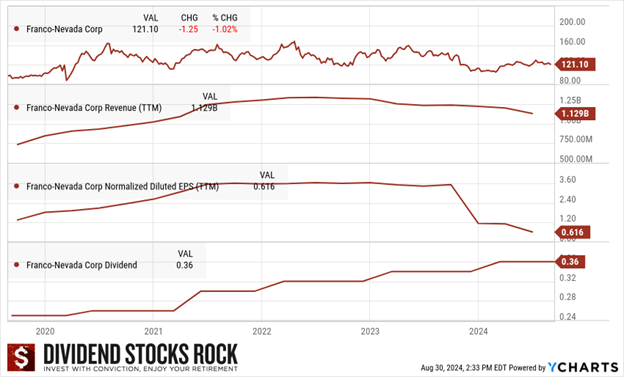

| Franco-Nevada Corp (FNV.TO) | Wheaton Precious Metals Corp (WPM.TO) |

| Nutrien (NTR.TO) |

Energy

| Canadian Natural Resources (CNQ.TO) | Parkland Corporation (PKI.TO) |

| Enbridge (ENB.TO) | Pembina Pipeline (PPL.TO) |

| Gibson Energy (GEI.TO) | South Bow (SOBO.TO) |

| Imperial Oil (IMO.TO) | TC Energy (TRP.TO) |

| North American Construction (NOA.TO) | Tourmaline Oil (TOU.TO) |

Even Better than an Aristocrat?

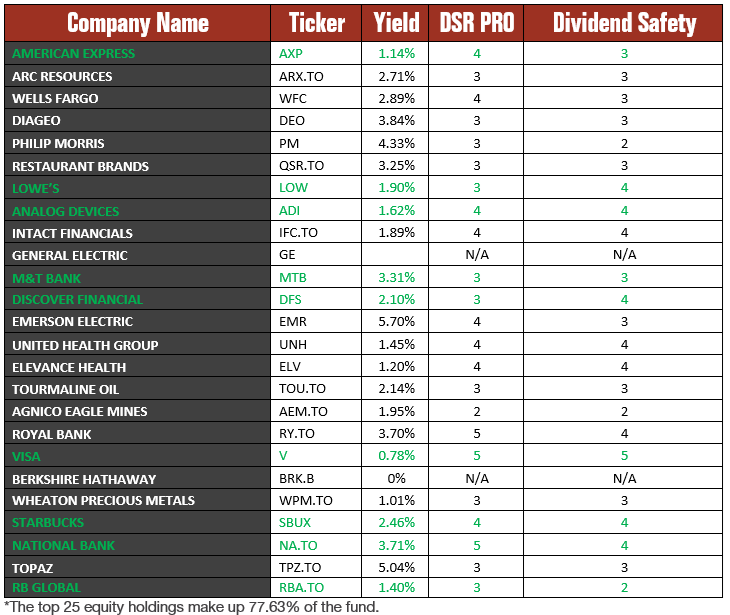

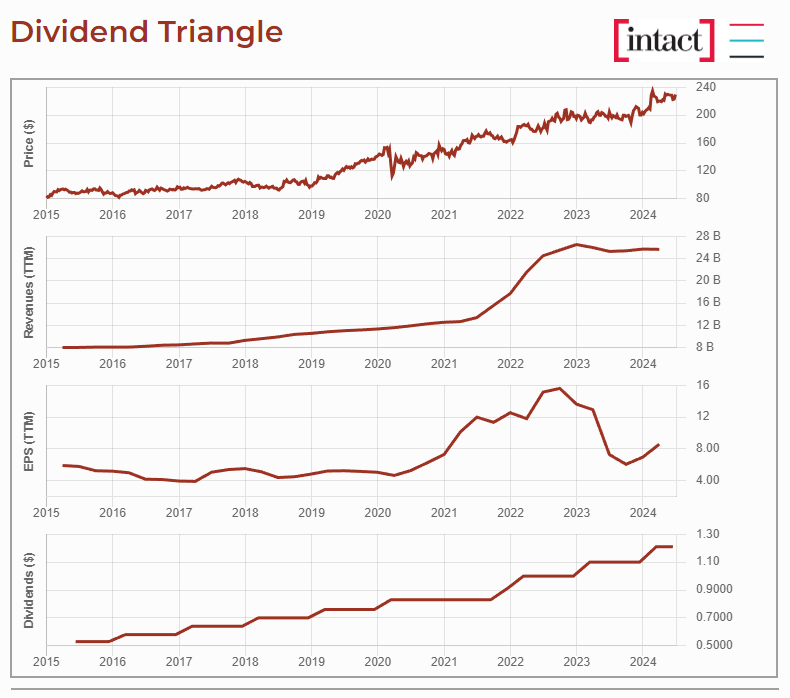

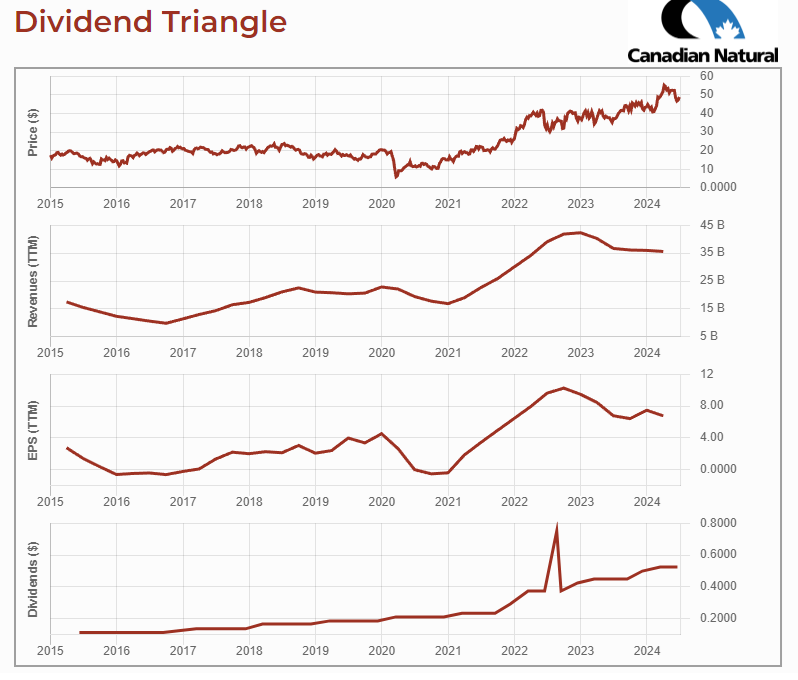

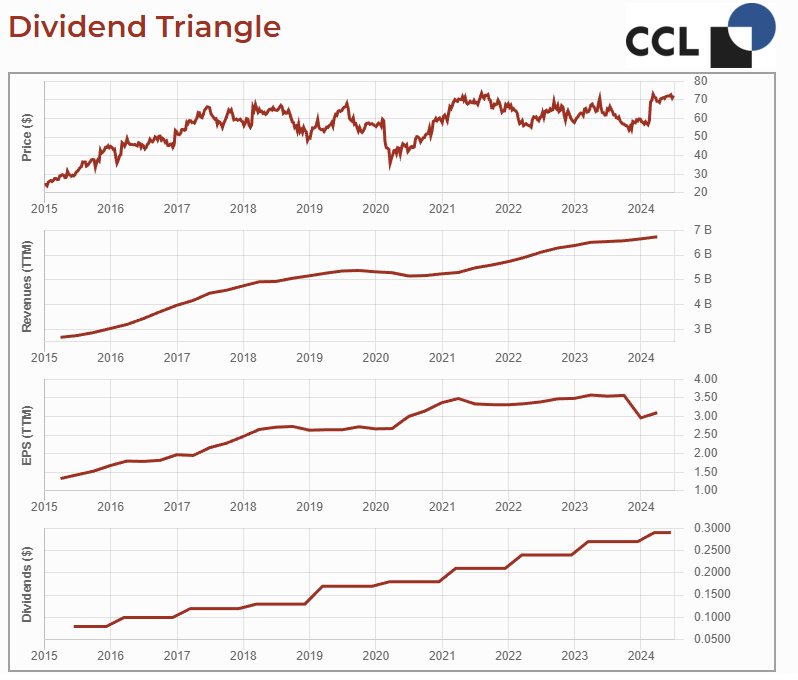

At Dividend Stocks Rock (DSR), we go further with our Canadian Rock Stars list, which we update and publish monthly. That list is even stronger than the Canadian Dividend Aristocraft list because we look beyond dividend growth. It is based on a combination of three metrics that I call the Dividend Triangle.

To be on the Rock Stars list, companies must show dividend, revenue, and EPS growth over 5 years. Growing revenue and profits fuel future dividend increases and make them more secure.

This simple focus on three metrics reduces your research time and helps you find companies with robust financials. Many aristocrats are on the Rock Star list, but not all. Also, the list includes many additional metrics and filters to help you narrow your search.

Download the Canadian Rock Stars list. We update it monthly!

Top 3 Canadian Dividend Aristocrats 2025

Using the methodology above, I’ve selected my favorite Canadian Aristocrats, who are also DSR Canadian Rock Stars.

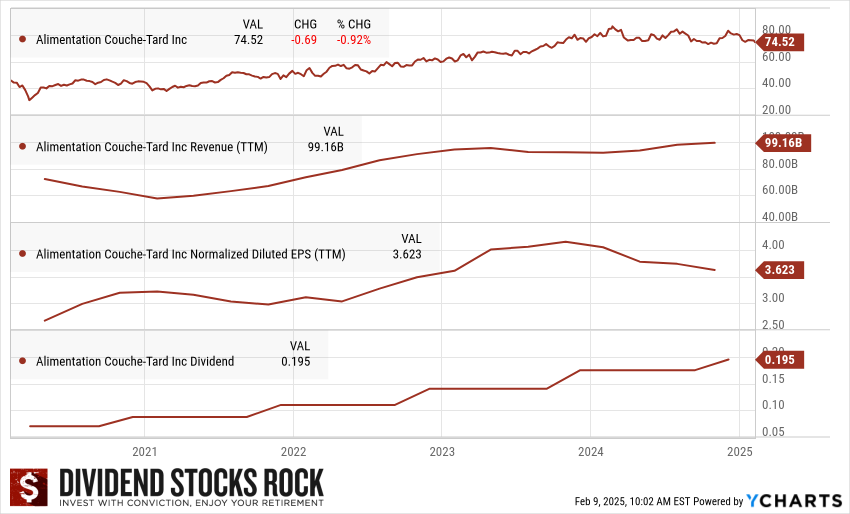

Alimentation Couche-Tard (ATD.TO)

Investment Thesis: Big Dividends and Bigger Acquisitions

In the long term, dividend payouts should grow in the double digits, and investors should see strong stock price growth. ATD’s potential is directly linked to its capacity to acquire and integrate additional convenience stores. Management has proven its ability to pay the right price and generate synergies for each acquisition. ATD exhibits a solid combination of the dividend triangle: revenue, EPS, and strong dividend growth. The company counts on multiple organic growth vectors such as Fresh Food Fast, pricing & promotion, assortment, cost optimization, and network development. ATD has a growth plan (10 for the win) to generate over $10B in EBTIDTA in 2028. This includes a mix of organic growth and acquisitions.

In 2023, ATD confirmed the acquisition of 2,193 stores from TotalEnergies for €3.1B (100% of retail assets in Germany and the Netherlands and a 60% controlling interest in the Belgium and Luxembourg entities). This will significantly expand ATD’s exposure to the European market and increase its total number of stores to surpass 16,000 worldwide.

ATD Eyes 7-Eleven: A Game-Changer or a Waiting Game?

In mid-2024, the company announced its intention to acquire Seven & I (7Eleven), the world’s largest (by number) convenience store operator. We are still in the first innings of this soap opera, and nothing is telling us there will be an agreement. 7-Eleven is playing hard to get. You are better off waiting to see if an accepted deal is on the table before calculating the future debt ratio!

Potential Risks: Expansion Challenges

Growers by acquisition are all vulnerable to occasionally making a bad purchase. While ATD’s method of acquiring and integrating more convenience stores has proven successful, it is essential for them not to grow too fast or become too eager, leading to possibly overpaying in the name of growth. The company exhibited this when it tried to acquire the French grocery store Carrefour. Still, we don’t think the next acquisition should be a source of concern with the current management team. The company is back into another drama with its will to acquire 7-Eleven.

EV Disruption, Declining Tobacco Sales & Economic Uncertainty

Investors are also worried about the potential impact of electric vehicles on fuel sales, but we believe ATD will overcome this challenge by installing superchargers. Another secular trend is the decline in cigarette sales. ATD sells a lot of tobacco and alcohol products. It must shift its product offering toward food and fresh produce (that’s already the plan).

Finally, the economy impacts ATD’s revenue and earnings. In 2024, we saw a weakening dividend triangle, which has started to raise concerns from the most pessimistic investors.

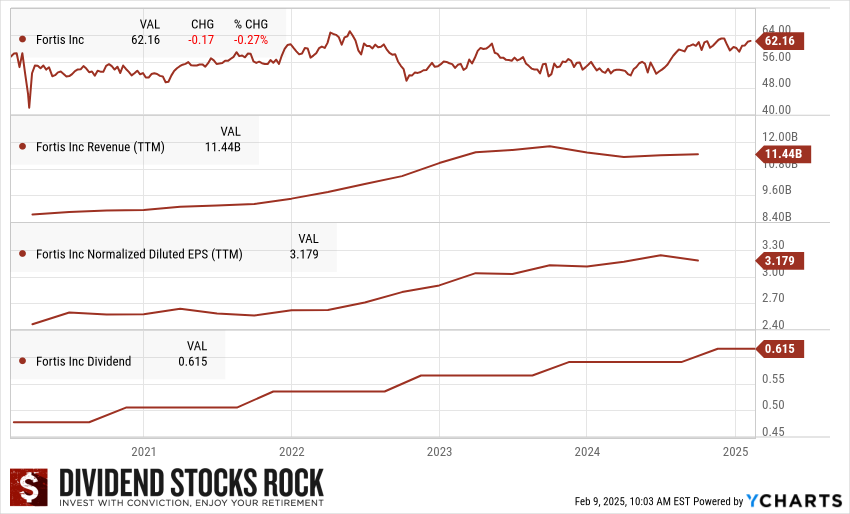

Fortis (FTS.TO)

Investment Thesis: A Powerhouse in Growth & Dividends

Fortis invested aggressively over the past few years, resulting in solid growth from its core business. An investor can expect FTS’ revenues to grow as it expands. Bolstered by its Canadian-based businesses, the company has generated sustainable cash flows leading to four decades of dividend payments. The company has a five-year capital investment plan of approximately $25 billion between 2024 and 2028. This plan is $2.7 billion higher than the previous five-year plan. The increase is driven by organic growth, reflecting regional transmission projects for several business segments. Only 33% of its CAPEX plan will be financed through debt, while 61% will come from cash from operations. Chances are that most of its acquisitions will happen in the U.S. We also like the company’s goal of increasing its exposure to renewable energy from 2% of its assets in 2019 to 7% in 2035. FTS reported Capital expenditures of $2.3 billion in the first half of 2024, keeping its $4.8 billion annual capital plan on track.

Investing Big in U.S. Transmission & Renewables

Fortis is advancing its strategic initiatives by focusing on regulated growth and sustainability. The company is progressing with key transmission investments, including the MISO Long-Range Transmission Plan, where ITC expects at least $3 billion in capital investment for projects in Michigan and Minnesota. Fortis is also exploring opportunities to expand and extend growth beyond the current capital plan, with potential investments in renewable gases and transmission projects supporting the delivery of offshore wind.

Potential Risks: Interest Rates, Regulations & Currency Risks

Fortis remains a utility company; in other words, don’t expect astronomical growth. However, Fortis’ current investment plan is enough to make investors smile. Fortis made two acquisitions in the U.S. to perpetuate its growth by opening the door to a growing market. However, it may be difficult for the company to grow to a level where economies of scale would be comparable to that of other U.S. utilities. The risk of high prices for other U.S. utilities is also present. Fortis runs capital-intensive operations, making its business model sensitive to interest rates. Finally, as most of its assets are regulated, each increase is subject to regulatory approval. While FTS has a long history of negotiating with regulators, demand for rate increases may be revised. Please also note that Fortis’ revenue is subject to currency fluctuations between the CAD and USD currencies.

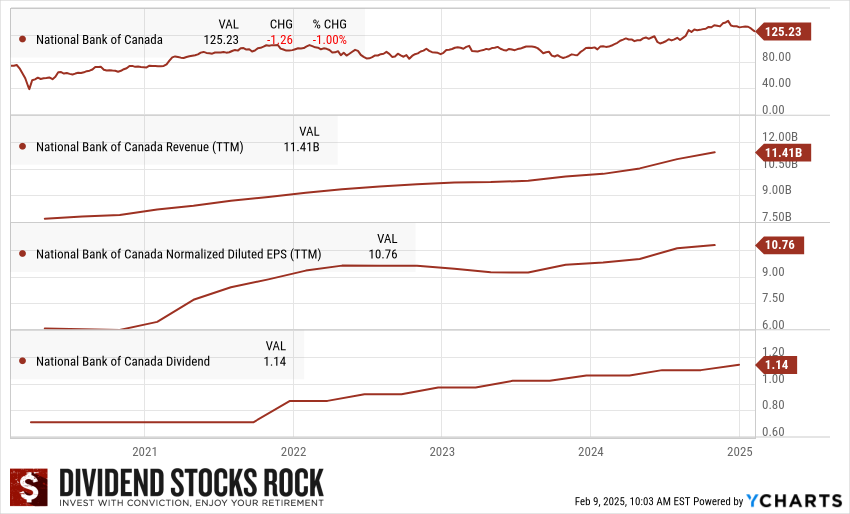

National Bank (NA.TO)

Investment Thesis: Winning Formula – Diversification, Acquisitions & Strong Dividends

NA has targeted capital markets and wealth management to support its growth. Private Banking 1859 has become a serious player in that arena. The bank opened private banking branches in Western Canada to capture additional growth. The bank now shows great diversification across its various business segments (with 50% of its revenue outside of classic savings & loans activities). Since NA is heavily concentrated in Quebec, it concluded deals to provide credit to investment and insurance firms under the Power Corp. (POW). In 2024, National Bank announced the acquisition of Canadian Western Bank (CWB.TO) for $5B. The deal is not closed yet (it is expected to close only at the end of 2025). If it happens, it will boost NA’s presence in Western Canada and open the door to more cross-selling opportunities amongst this new book of clients, as CWB doesn’t currently offer a service such as Private Banking 1859.

From Quebec to Cambodia

The stock has outperformed the Big 5 for the past decade as it has shown strong results. National Bank has been more flexible and proactive in many growth areas, such as capital markets and wealth management. Currently, NA is seeking additional growth vectors by investing in emerging markets such as Cambodia (ABA bank) and the U.S. through Credigy. We wonder if it can achieve more success than BNS on international grounds. This is one of the rare Canadian stocks having a near-perfect dividend triangle.

Potential Risks: Market Volatility & Economic Shifts

National Bank is still highly dependent on Quebec’s economy, as about half of its revenue comes from this province. As a hyper-regional bank, NA is more vulnerable to local economic events. This has not affected the bank significantly, but we advise keeping track of its credit loss provisions. Recessions and rising interest rates could also affect the bank’s debt portfolio. Financial markets’ revenues are also highly volatile. We often mention that financial markets could save or wreck the day–NA may experience a bad quarter if the stock market becomes bearish.

Overall, the bank has performed very well, but it usually takes more risk to identify growth vectors (such as the ABA bank investment and capital markets). So far, it has paid off, but it does not mean it will always be this way. Remember that investments in emerging markets are unpredictable and could shift very quickly.

Get More Stock Ideas: The Canadian Rock Stars List

Are you curious about the other Rock Stars on the list? Access to about 300 companies showing a positive dividend triangle (5-year revenue, earnings per share (EPS), and dividend growth trends) with filters.

Start your stock research on the right foot with the best Dividend Stocks List. Enter your name and email below.

#1 List the TSX 60 index by dividends.

#1 List the TSX 60 index by dividends. #2 Select the top 10 yielding stocks from the TSX 60

#2 Select the top 10 yielding stocks from the TSX 60 #3 Buy the top 10 yielding stocks in equal weight.

#3 Buy the top 10 yielding stocks in equal weight. #4 Each January, review the new Dogs of the TSX and trade accordingly.

#4 Each January, review the new Dogs of the TSX and trade accordingly.