For income investors, regulated utilities offer something rare in the market: steady cash flow, predictable growth, and limited competitive threats. This company fits squarely in this category, with an entrenched position in Ontario’s electricity transmission and distribution network. While it’s not immune to political interference, its unique role in the province’s infrastructure makes it a compelling option for long-term dividend growth.

Keeping Ontario Connected: Hydro One’s Business Model

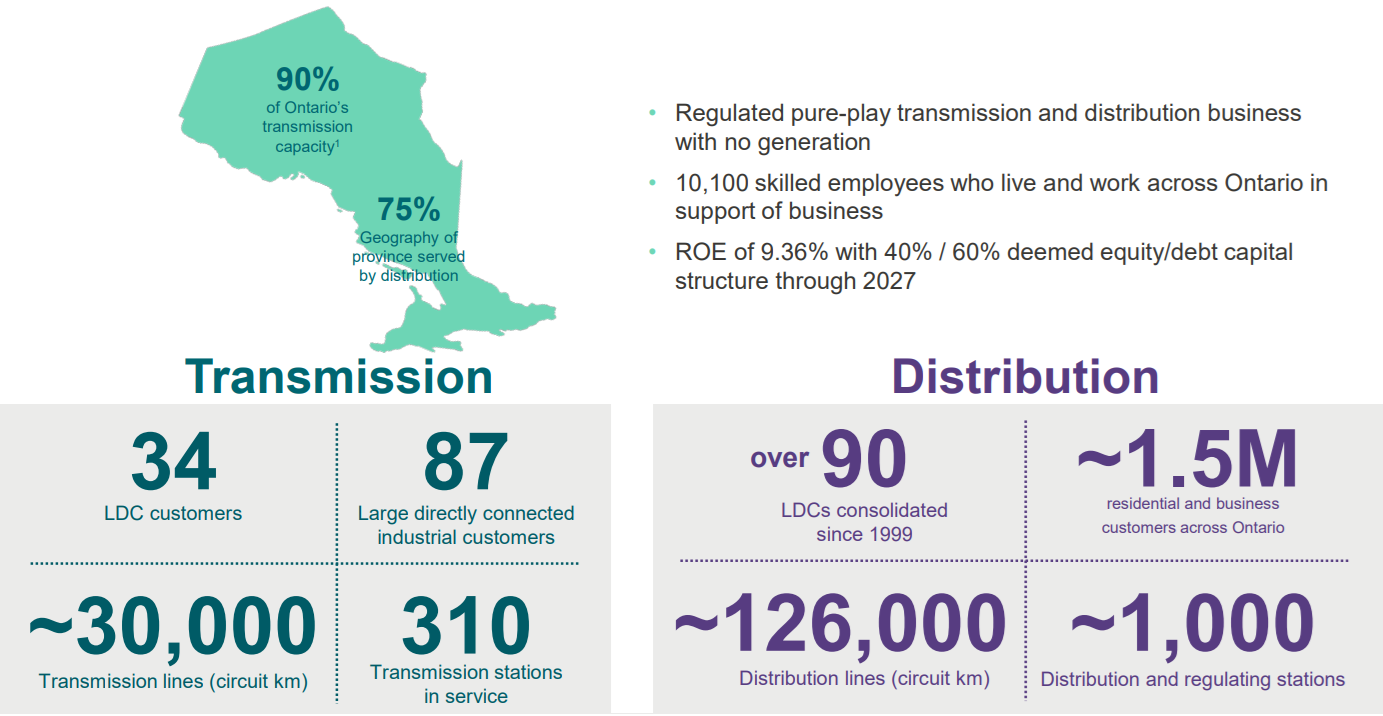

Hydro One (H.TO) operates almost entirely in Ontario, delivering electricity to roughly 1.5 million customers. Its business is split into:

-

Transmission (≈60% of revenue) – High-voltage power delivery across the province, including connections to local utilities and large industrial users.

-

Distribution (≈40% of revenue) – Supplying electricity to end users and municipal distributors.

-

Other Activities – Includes the Ivy Charging Network for EV fast charging and a small telecom segment.

This regulated structure means Hydro One earns a fixed, regulator-approved return on its assets, creating highly predictable revenue.

The Bull Case: Building for the Future

A Monopoly with Predictable Cash Flow

Hydro One is the sole large-scale electricity transmission and distribution provider in Ontario. This monopoly structure means that, regardless of economic fluctuations, the company benefits from an entrenched customer base that cannot easily switch providers. Its revenue streams are supported by regulator-approved rates, which reduce earnings volatility and provide visibility into future cash flows—an attractive trait for dividend investors.

Multi-Year Capital Investment Program

One of Hydro One’s biggest growth levers is its robust capital investment plan, committing $1.3–$1.6 billion annually through 2027. These investments focus on modernizing Ontario’s grid, expanding transmission capacity, and integrating renewable energy sources. The recently completed Chatham-to-Lakeshore transmission project is a prime example of how these projects feed into earnings growth and strengthen the company’s infrastructure advantage. Beyond 2027, Hydro One is already mapping out additional projects that could extend this growth runway well into the next decade.

Benefiting from Electrification and Renewable Integration

As Ontario moves toward greater electrification—driven by electric vehicle adoption, heat pump installations, and renewable power integration—Hydro One’s infrastructure will be at the center of this transition. This shift is expected to increase electricity demand significantly, requiring both expansion of capacity and upgrades to handle more complex grid operations. The company’s expertise and entrenched position make it a natural partner for government initiatives aimed at decarbonization.

A Strong Provincial Economy as a Backdrop

Ontario’s economy is both the largest and one of the most diversified in Canada. From advanced manufacturing to technology and services, the province’s economic resilience supports steady electricity demand. This, in turn, gives Hydro One a solid foundation for planning long-term capital deployment without fearing sudden drops in usage patterns.

Clear Earnings Growth Path

Management projects EPS growth of 6–8% annually from 2023 to 2027, with a normalized 2022 EPS of CAD 1.61 as the baseline. This growth is expected to be supported by approved capital projects, organic demand growth, and potential acquisitions of municipal utilities. Combined with disciplined cost management, this sets the stage for steady dividend increases in the mid-single digits.

The Ultimate Safe List to Get Dividend Growth Stock Ideas

To help you build a solid portfolio with dividend growth stocks, I have created the Canadian Rock Stars List, showing about 300 companies with growing trends.

You can read on to understand how it is built and why it’s the ultimate list for Canadian dividend investors, or you can skip to the good stuff and enter your name and email below to get the instant download in your mailbox.

The Bear Case: Political and Regulatory Headwinds

Political Influence and Governance Risk

The Ontario government owns 47% of Hydro One, which gives it significant influence over corporate governance. This has already manifested in the past when political leaders intervened to force leadership changes, disrupting corporate continuity. For long-term investors, this adds an unpredictable layer of risk—decisions may be made for political rather than financial reasons.

Regulatory Constraints on Profitability

H.TO operates in one of the more restrictive regulatory environments in North America. The Ontario Energy Board (OEB) sets allowable returns on equity, which are generally lower than what many U.S. utilities can achieve. This limits Hydro One’s ability to boost profitability even when operational performance is strong. It also reduces flexibility in responding to inflationary pressures or unexpected cost increases.

Interest Rate Sensitivity and Debt Load

Like most utilities, Hydro One carries significant debt to fund its capital projects. While this is standard for the industry, the company is vulnerable to rising interest rates, which increase borrowing costs and can erode profitability. Higher financing costs could also reduce the capital available for new projects, slowing the pace of growth. With long-term debt a constant feature of its balance sheet, even a modest rate shift can impact future earnings projections.

Geographic Concentration and Lack of Diversification

All of Hydro One’s core operations are within Ontario. While the provincial economy is stable, this geographic concentration means that any significant economic downturn, policy shift, or regulatory change in Ontario could have an outsized impact on the business. Unlike diversified peers such as Fortis or Emera, Hydro One does not have operations in other provinces or countries to offset regional risks.

Comparing with Peers

When placed alongside Canadian peers like Fortis (FTS.TO) and Emera (EMA.TO), Hydro One’s lower allowed return on equity and higher degree of political oversight become clear disadvantages. While Fortis and Emera operate in multiple jurisdictions—often with more favorable regulatory frameworks—Hydro One remains locked into a single, more restrictive environment. This reality caps its long-term return potential relative to more geographically diverse utilities.

What’s New: Solid Growth and a Dividend Boost

Hydro One’s most recent quarter (Q1 2025) underscored its steady trajectory:

-

Revenue: +11% YoY, driven by higher demand and regulator-approved rate increases.

-

EPS: +22% YoY.

-

Dividend: +6% increase announced.

-

Transmission revenue rose 15%, fueled by demand growth and rate changes.

-

Distribution revenue climbed 6.3% thanks to stronger consumption and 2025 rate adjustments.

-

Chatham-to-Lakeshore project energized in Dec 2024, contributing to results.

-

Guidance reaffirmed: 6–8% annual EPS growth through 2027.

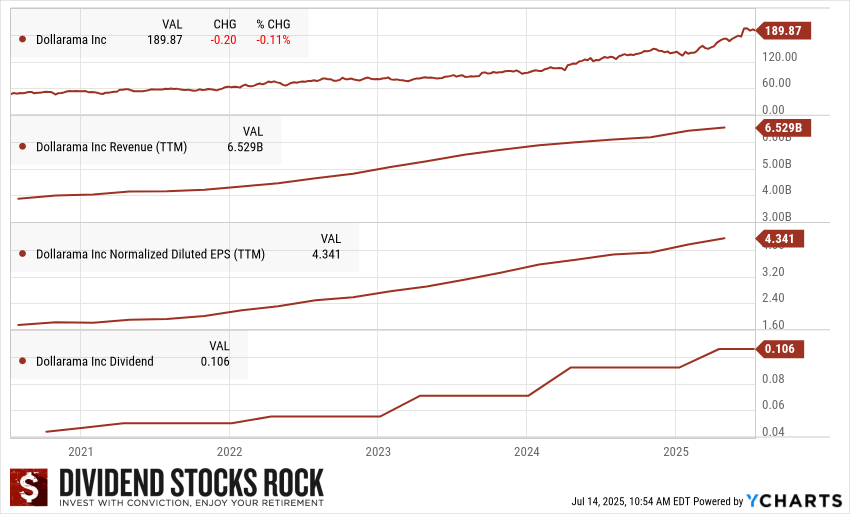

The Dividend Triangle in Action: Hydro One’s Steady Climb

Hydro One’s dividend triangle reflects its reliability:

-

Revenue Growth – Gradual, supported by capital projects and rate increases.

-

EPS Growth – Stronger growth from efficiency gains, regulated returns, and infrastructure expansion.

-

Dividend Growth – Modest but consistent, typically in the mid-single digits, in line with earnings growth.

While not a high-yield play, Hydro One offers predictable dividend growth—ideal for compounding income over the long term.

The Dividend Rock Stars List: The ONLY List Using the Dividend Triangle

The dividend triangle is an exclusive concept developed at Dividend Stocks Rock (DSR).

The dividend triangle is an exclusive concept developed at Dividend Stocks Rock (DSR).

While many seasoned investors use these metrics in their analysis, no one has created a list based on them before.

Don’t waste any more time with complex strategies and dozens of metrics duplicating each other: focus on quality and download the list with filters now.

Final Take: A Reliable, Regulated Income Play

Hydro One isn’t the most exciting stock on the market, but for investors seeking stability, modest growth, and reliable dividends, it’s a solid fit. Political risk and regulatory limits mean returns will never be explosive, but the predictability of cash flows and the essential nature of its services make it a dependable long-term holding.