A foundational stock, or core holding, is one you can buy and forget about for 10 years without worry. TFI International (TFII.TO) is such a stock. A sleep-well-at-night investment you know will be around 10 years from now and give you growth. Find out more about TFII.

Build on foundational stocks to create income for life! Learn more in our Dividend Income for Life Guide!

TFI International Business Model

TFI International is one of the largest trucking companies in North America. Its segments include Package and Courier, Less-Than-Truckload, Less-Than-Truckload, and Logistics.

Package and Courier picks up, transports, and delivers items across North America. Less-Than-Truckload picks up small loads, consolidates, transports, and delivers them. The Truckload segment offers conventional and specialized truckload services, including flatbed trucks, tanks, dumps, and oversized. It offers specialized trailers and a million-plus square feet of industrial warehousing space. Logistics provides asset-light logistical services, including brokerage, freight forwarding, transportation management, and small package parcel delivery. TFII hauls compostable and recyclable materials and offers residential waste management services.

Package and Courier picks up, transports, and delivers items across North America. Less-Than-Truckload picks up small loads, consolidates, transports, and delivers them. The Truckload segment offers conventional and specialized truckload services, including flatbed trucks, tanks, dumps, and oversized. It offers specialized trailers and a million-plus square feet of industrial warehousing space. Logistics provides asset-light logistical services, including brokerage, freight forwarding, transportation management, and small package parcel delivery. TFII hauls compostable and recyclable materials and offers residential waste management services.

With its size and vast network, it enjoys economies of scale, giving it an edge over the competition. While it competes with lower-cost rail transportation, the flexibility of truck transport means there will always be demand.

Another benefit of TFII’s size is that it can buy smaller competitors to fuel its growth. It has completed over 80 acquisitions since 2008.

TFII.TO Investment Thesis

Since TFI International is expanding, it might be time to invest and ride with them for a while. It made a wise move to expand outside Canada since the U.S. and Mexican economies have great potential.

With a larger fleet, TFI will be ready to pick up any available steady growth. Investing in a leader in Canada and North America is a safe bet for any investor looking to build a dividend growth portfolio. The company displays an appetite for further growth by acquisition that bodes well for the years to come. TFI completed the major acquisition of UPS Freight in April 2021 and it’s already a transformational success. The company is expanding its margins as it benefits from additional economies of scale and the network effect.

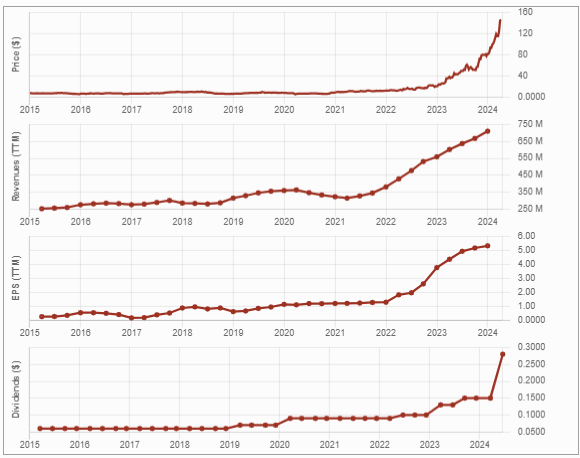

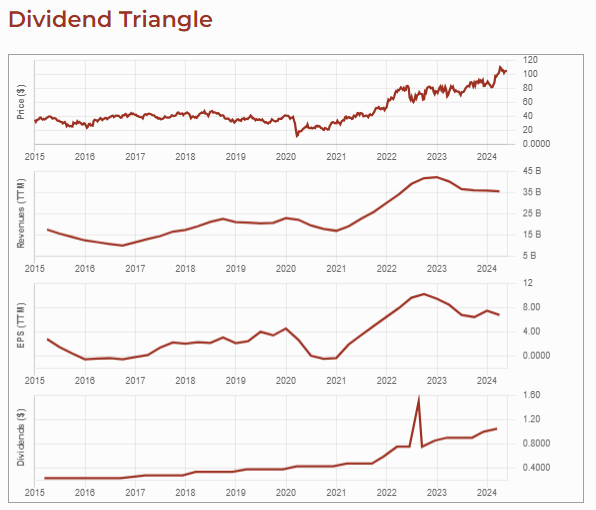

Below is TFII’s stock price evolution over 10 years, as well as its revenue, EPS, and dividend growth. Note that what looks like a dividend cut in the dividend triangle graph in April 2021 was really a conversion to USD when TFII started paying its dividend in US currency.

TFII could see some headwinds for a bit as many economists expect a recession. However, this also means TFII should remain in a solid position to make more acquisitions as smaller competitors may struggle in this economy.

Potential Risks for TFII

While road transportation beats railroads in flexibility, railroads win on cost. The transportation industry is highly cyclical; stock values could suffer in downturns. Oil prices affect the trucking industry; there is a limit in fuel surcharges companies can add to their bill.

TFII will have to identify other potential mergers and acquisitions transactions to ensure continued earnings growth. The organic trucking business stay cyclical in the future. The next time we hit a recession, the stock price could drop rapidly. Remember that TFII is a volatile stock. On one earnings day, the stock price fell 8% on weaker-than-expected results. Finally, if there is a tariff war in North America, TFII will be stuck in the middle.

TFII Dividend Growth Perspective

TFII has had consecutive dividend increases since 2016. While it has a 5-year dividend growth rate over 13% (CAGR), the payout ratios remain low. This leaves much room for increases in its dividend payout. We would have liked to see a smoother trend for earnings, but the dividend payouts aren’t at risk for now. In 2023, TFII rewarded shareholders with a dividend increase of 14%, and another one of 12.5% in 2024!

Get more information about creating sustainable dividend income in our Dividend Income for Life Guide.

In Closing

TFI International (TFII.TO) is a great foundational stock for any portfolio. You can be confident that, though volatile, a position in this stock will grow over time. Of course, when we say you can “forget” about a foundational stock for 10 years, we’re exaggerating. It’s still best practice to monitor all your holdings quarterly, including TFII. With foundational stocks, however, I don’t spend much time or dig too deep into the quarterly results unless I see signs of trouble, which I rarely do.

AP.UN.TO maintains its unique expertise in managing and developing prime heritage locations, which will continue to be in high demand in the coming years. The REIT also counts on many technology clients, which represent a growing sector in Canada.

AP.UN.TO maintains its unique expertise in managing and developing prime heritage locations, which will continue to be in high demand in the coming years. The REIT also counts on many technology clients, which represent a growing sector in Canada.

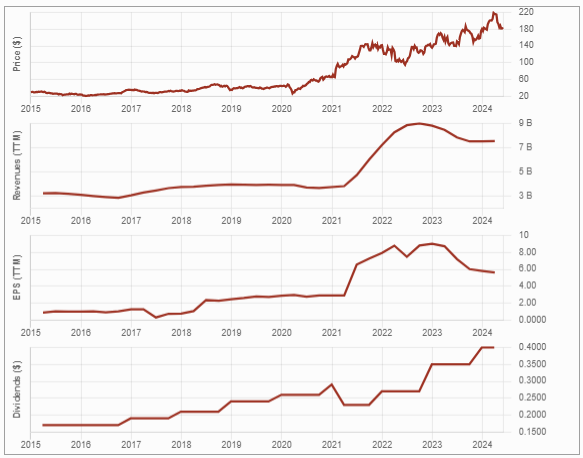

But CNR is more than railway transport! Its services also include intermodal, trucking, and supply chain services. CNR’s rail services offer equipment, customs brokerage services, transloading and distribution, private car storage, and more. Intermodal container services help shippers expand their door-to-door market reach with ~23 strategically placed intermodal terminals. These services include temperature-controlled cargo, port partnerships, logistics parks, moving grain in containers, custom brokerage, transloading and distribution, and others. Trucking services include door-to-door service, import and export dray, interline services, and specialized services.

But CNR is more than railway transport! Its services also include intermodal, trucking, and supply chain services. CNR’s rail services offer equipment, customs brokerage services, transloading and distribution, private car storage, and more. Intermodal container services help shippers expand their door-to-door market reach with ~23 strategically placed intermodal terminals. These services include temperature-controlled cargo, port partnerships, logistics parks, moving grain in containers, custom brokerage, transloading and distribution, and others. Trucking services include door-to-door service, import and export dray, interline services, and specialized services.

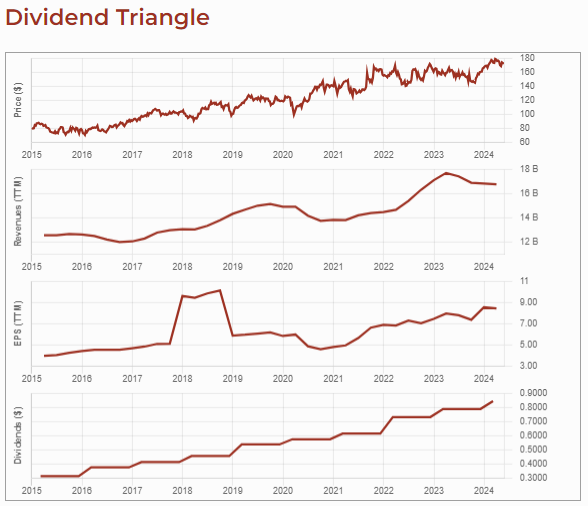

BAM offers three product categories: long-term private funds, perpetual strategies, and liquid strategies. It operates through Brookfield Asset Management itself and its subsidiaries.

BAM offers three product categories: long-term private funds, perpetual strategies, and liquid strategies. It operates through Brookfield Asset Management itself and its subsidiaries.

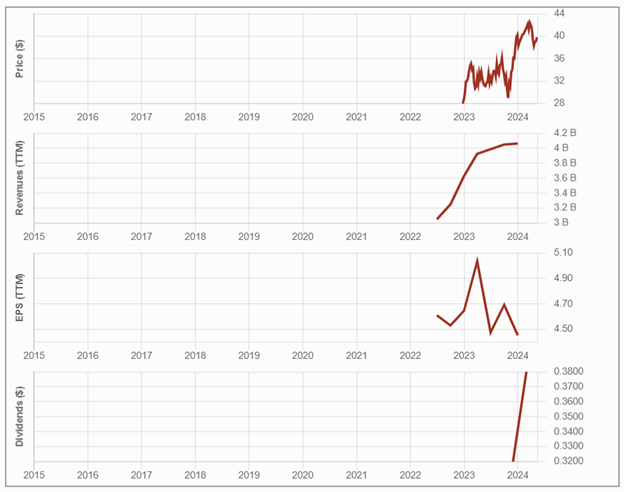

In early May, Brookfield Asset Management reported a good Q1 2024. It showed strong growth of 15% in its fee revenue from its flagship, private credit, and insurance strategies over the past year, on the back of over 15% growth in related fee-bearing capital over the same period. BAM saw lower transaction fees and lower fees associated with its permanent capital vehicles. BAM raised $20B of capital during the quarter, compared with $37B in Q4 2023.

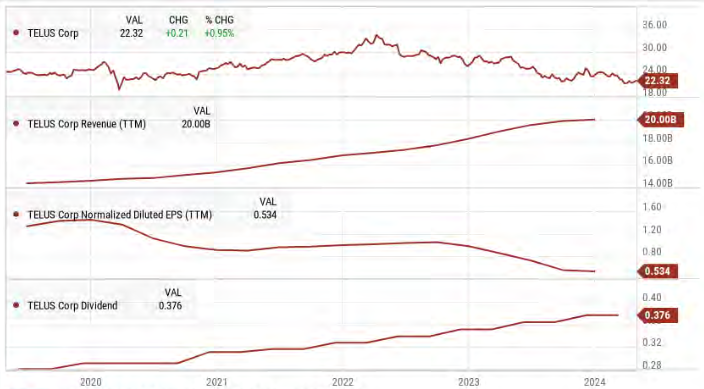

In early May, Brookfield Asset Management reported a good Q1 2024. It showed strong growth of 15% in its fee revenue from its flagship, private credit, and insurance strategies over the past year, on the back of over 15% growth in related fee-bearing capital over the same period. BAM saw lower transaction fees and lower fees associated with its permanent capital vehicles. BAM raised $20B of capital during the quarter, compared with $37B in Q4 2023. Telus has grown its revenues, earnings, and dividend payouts very consistently. Very strong in the wireless industry, the company is now tackling other growth vectors such as internet and television services. Telus has the best customer service in the wireless industry as shown by its low customer loss rate. It uses its core business to cross-sell its wireline services. The company is particularly strong in Western Canada. Telus is well-positioned to surf the 5G technology tailwind.

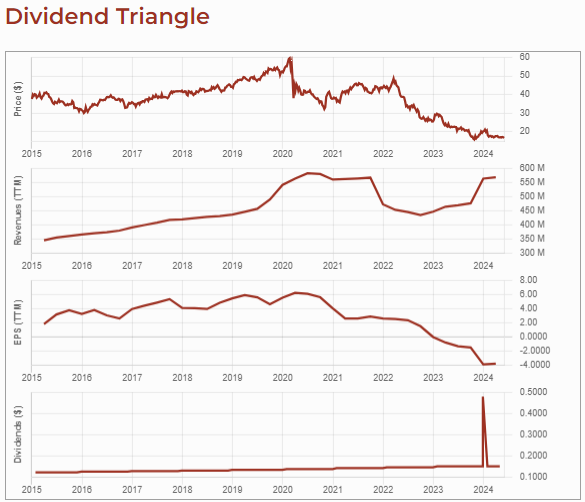

Telus has grown its revenues, earnings, and dividend payouts very consistently. Very strong in the wireless industry, the company is now tackling other growth vectors such as internet and television services. Telus has the best customer service in the wireless industry as shown by its low customer loss rate. It uses its core business to cross-sell its wireline services. The company is particularly strong in Western Canada. Telus is well-positioned to surf the 5G technology tailwind.

success internationally but had to close its Italian division and continues to struggle in India. However, after closing its Italian business, the company focused on what’s working for it in North America.

success internationally but had to close its Italian division and continues to struggle in India. However, after closing its Italian business, the company focused on what’s working for it in North America.