This Canadian company is a global heavyweight when it comes to labels, packaging, and tracking tech. From shampoo bottles to RFID tags, it has its fingerprints on thousands of everyday products — and it keeps showing up with results.

It just posted a strong quarter (revenue and EPS up 9%) and remains off most investors’ radars. But behind the scenes, this business has been compounding steadily with a blend of smart acquisitions, global diversification, and consistent dividend growth.

Let’s peel back the label and take a proper look at what’s underneath.

Business Model: Labeling the World

CCL Industries is a global leader in specialty label and packaging solutions with operations in 42 countries. It operates across four key segments:

-

CCL (labels and containers for consumer and healthcare goods)

-

Avery (printable media and office products)

-

Checkpoint (RF/RFID tech for retail security and tracking)

-

Innovia (specialty multilayer films and polymer banknotes)

The company earns revenue from long-term contracts, recurring customer orders, and broad exposure to industries like consumer staples, pharma, logistics, and retail.

Their combination of essential products and global reach makes the business resilient, even when headlines scream recession.

Investment Thesis: Diversified and Disciplined

CCL Industries doesn’t depend on a single market, product, or trend. That’s part of the appeal. It combines consistent organic growth with smart, bolt-on acquisitions. The company’s 2013 acquisition of Avery, followed by Innovia and Checkpoint, helped reshape its business into a multi-pronged revenue machine.

Even in a cost-sensitive world, labeling and packaging remain critical — and CCL keeps adding value through higher-margin segments like RFID, polymer banknotes, and specialty films.

It’s also one of those rare businesses in the material sector that behaves more like a compounder: efficient operations, strong ROE, and a steady dividend growth history.

The Ultimate Safe List to Get Dividend Growth Stock Ideas

To help you build a solid portfolio with dividend growth stocks, I have created the Canadian Rock Stars List, showing about 300 companies with growing trends.

You can read on to understand how it is built and why it’s the ultimate list for Canadian dividend investors, or you can skip to the good stuff and enter your name and email below to get the instant download in your mailbox.

Bull Case: Labeling Growth Across the Globe

CCL is a well-managed, acquisition-savvy company with a habit of integrating well and producing solid results. The latest quarter showed strong momentum in core segments, especially:

-

Organic growth of 3.8%

-

Strong demand in home & personal care

-

Growth in Europe, Mexico, and the Americas

-

Positive currency impact and margin stability

The company also announced a share buyback of 8.82% of issued capital, which is a strong vote of confidence from management.

Its global scale, product diversification, and recurring cash flow make it a stable performer in volatile markets.

Bear Case: Margin Pressures & Acquisition Risks

Of course, nothing is perfect.

CCL is still part of the materials sector, which means it’s exposed to raw material price swings. As inflation and logistics costs rise, so do the risks to margins — and there’s only so much pricing power before customers push back.

It also relies heavily on acquisitions for growth. While past deals have been smart, no streak lasts forever. And restructuring costs in Checkpoint ($0.8M) serve as a reminder that not every unit is a smooth operator.

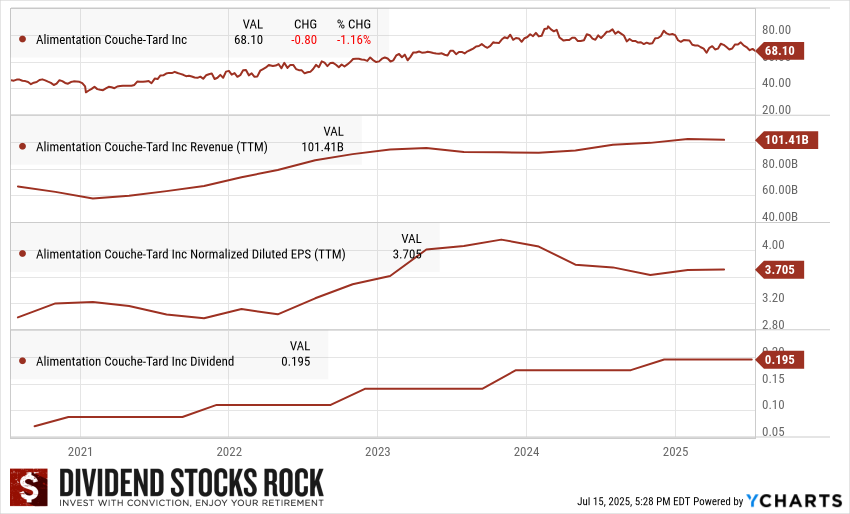

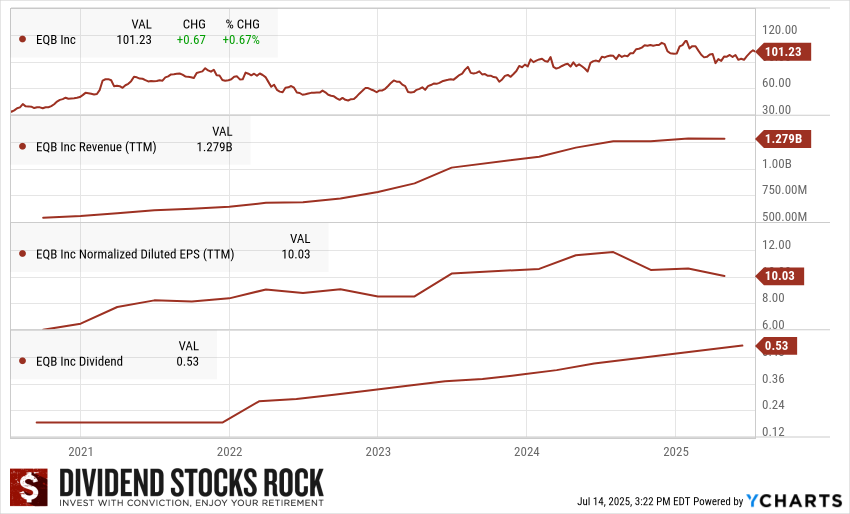

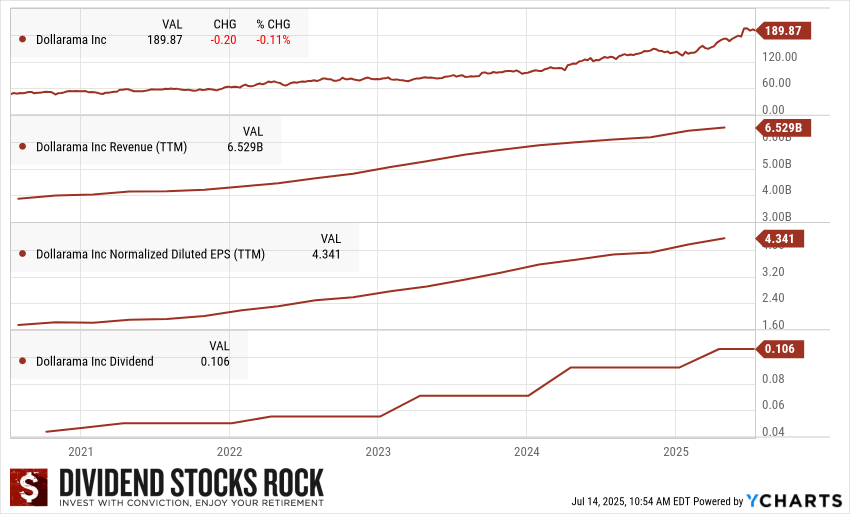

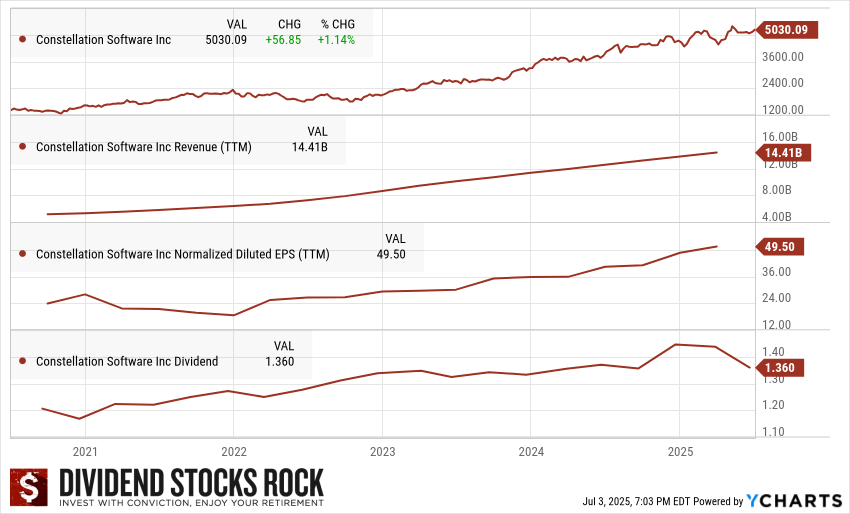

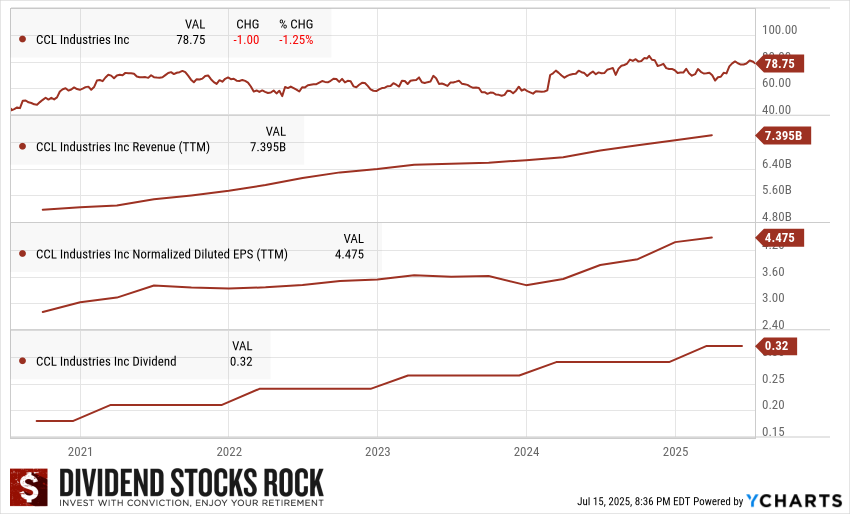

The Dividend Triangle in Action

Let’s see how CCL performs on our three-part Dividend Triangle:

-

Revenue: Consistent upward trend, now at $7.4B

-

EPS: Solid long-term growth, with a strong Q1 rebound

-

Dividend: Slowly and steadily increasing — with a low payout ratio

While the yield remains modest (~0.4%), it’s growing, and CCL has plenty of room to accelerate it down the line.

Latest Results Recap

On May 26, 2025, CCL Industries reported:

-

Revenue up 9%

-

EPS up 9%

-

Strong organic growth in Home & Personal Care

-

Innovia performed well; Checkpoint faced $0.8M in severance-related costs

-

Announced share buyback for up to 8.82% of capital

It was a very solid quarter overall — no surprises, just execution.

The Dividend Rock Stars List: The ONLY List Using the Dividend Triangle

The dividend triangle is an exclusive concept developed at Dividend Stocks Rock (DSR).

The dividend triangle is an exclusive concept developed at Dividend Stocks Rock (DSR).

While many seasoned investors use these metrics in their analysis, no one has created a list based on them before.

Don’t waste any more time with complex strategies and dozens of metrics duplicating each other: focus on quality and download the list with filters now.

Final Word: Built to Scale and Last

This stock does grab results. Over the years, it’s turned packaging and labeling into a high-margin, global business, driven by innovation, disciplined acquisitions, and rock-solid execution.

It may not offer a sky-high yield, but it delivers where it counts: steady growth, strong cash flow, and the kind of business that keeps performing across market cycles.

If you’re looking to anchor your dividend portfolio with quality names that can weather economic cycles, CCL.B.TO is one to watch.