We aim to spotlight Brookfield Asset Management, the new kid in the Brookfield family of companies. In 2022, Brookfield separated its asset-light management business as BAM and renamed the parent company, which was called Brookfield Asset Management, to Brookfield Corporation (BN). Confused? You’re not alone. So, BAM is an asset-light alternative asset manager…what the heck is that and is it a worthy investment?

Create your own recession-proof portfolio! Learn how in our free workbook. Download it now!

Alternative assets and asset-light management

Alternative assets are non-traditional investment opportunities different from conventional asset classes like stocks, bonds, and cash. Examples include real estate, private equity, infrastructure, venture capital, commodities, etc. Such assets are not as liquid as conventional assets and require expert management. They can also take longer to generate returns; for example, it can take several years for venture capital invested in a new startup or capital put into new complex infrastructure projects to create high returns. They demand patience from investors.

An asset-light management business like BAM doesn’t have many physical assets. It develops strategies, manages, and leverages funds from institutional investors, such as pension plans, retail clients, and other investors. It invests these funds into varied assets, which can include physical assets like those operated by other Brookfield companies, such as Brookfield Renewables and Brookfield Infrastructure. BAM makes most of its money from fees charged on its total assets under management (AUM).

Learn about another Brookfield company, Brookfield Infrastructure.

About Brookfield Asset Management

BAM offers three product categories: long-term private funds, perpetual strategies, and liquid strategies. It operates through Brookfield Asset Management itself and its subsidiaries.

BAM offers three product categories: long-term private funds, perpetual strategies, and liquid strategies. It operates through Brookfield Asset Management itself and its subsidiaries.

Brookfield Corporation (BN.TO / BN), the parent company of the Brookfield family, owns 75% of BAM.

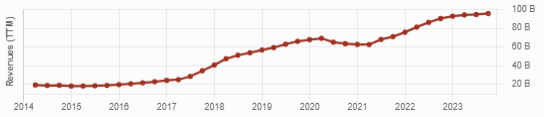

Spinning off the asset-light management business into BAM enabled Brookfield to create a capital-light company with zero debt and lots of cash and financial assets to support growth. To be clear though, Brookfield’s debt didn’t disappear, but rather wasn’t transferred to the asset management business (BAM).

BAM investing narrative

BAM makes money by charging fees on AUM. Therefore, the more money it raises for investments, the more its earnings grow. Since supply and demand influence AUM, you can expect BAM to show cyclical growth as the market fluctuates.

Even though alternative assets require more time to produce returns on the market than equities, investors tend to be nervous during bear markets; this affects alternative asset managers. We saw how a bad market in 2022 combined with higher interest rates increased nervousness and impacted all asset managers, alternative or not.

BAM will likely grow its AUM at double-digit growth rates for many years. The urgent need to invest in infrastructure and renewable energy will attract lots of money to the largest alternative asset managers. BAM is among the largest ones with approximately $929B of assets under management (up 11.4% from a year ago). If BAM can increase its AUM during a bad market like what we’ve seen since 2022 (+15% between 2022 and 2023, and +11.4% from 2023 to 2024), imagine what will happen when the market goes back into bull mode!

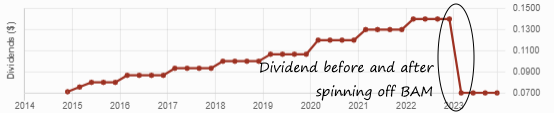

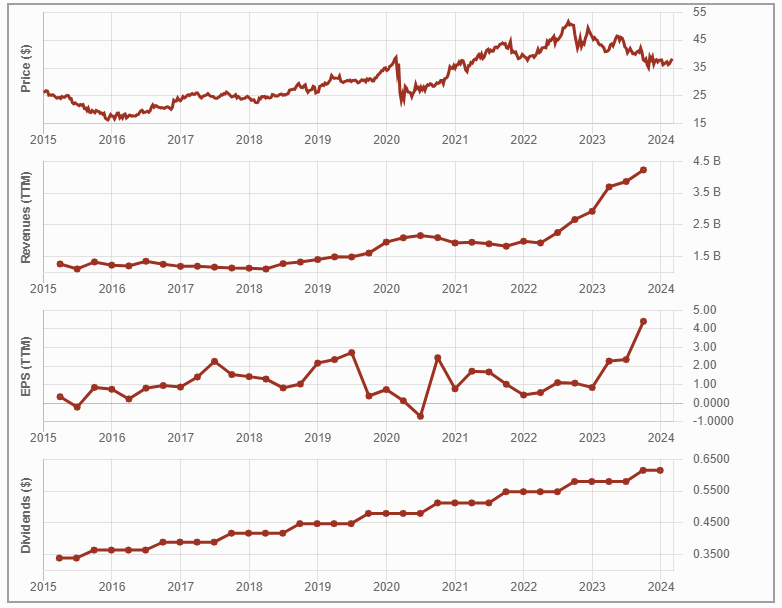

Below is the evolution of BAM’s stock price since the spin off in late 2022, and of its revenue, EPS, and dividend. Eighteen months isn’t a trend yet, but BAM’s off to a good start.

As most of BAM’s clients are pension plans, sovereign funds, insurance companies, and the like (e.g., big guys with big wallets and a long-time horizon), BAM’s portfolio will generate a constant income stream. Since most of its earnings come from fees charged on the AUM (as opposed to performance fees on how well they do), BAM has built a sticky business.

Recently for BAM

In early May, Brookfield Asset Management reported a good Q1 2024. It showed strong growth of 15% in its fee revenue from its flagship, private credit, and insurance strategies over the past year, on the back of over 15% growth in related fee-bearing capital over the same period. BAM saw lower transaction fees and lower fees associated with its permanent capital vehicles. BAM raised $20B of capital during the quarter, compared with $37B in Q4 2023.

In early May, Brookfield Asset Management reported a good Q1 2024. It showed strong growth of 15% in its fee revenue from its flagship, private credit, and insurance strategies over the past year, on the back of over 15% growth in related fee-bearing capital over the same period. BAM saw lower transaction fees and lower fees associated with its permanent capital vehicles. BAM raised $20B of capital during the quarter, compared with $37B in Q4 2023.

Potential Risks for Brookfield Asset Management

BAM’s growth depends on investors’ confidence in long-term projects. When panic arises, it becomes difficult for companies like BAM to increase their AUM.

Brookfield invests for a time horizon of decades, while investors tend to be hungry for short-term news. This distortion often translates into short-term fluctuations and stock price drops. Well-managed, BAM has the expertise to navigate crises. Investors must simply be patient. The Brookfield family of companies is complex, which makes some investors wonder how money is managed within the business, including in BAM.

Build yourself a recession-proof portfolio! Learn how in our free workbook. Download it now!

BAM.TO / BAM Dividend Growth Perspective

The management team in place has an enviable reputation for generating growth for investors. This is also true when it comes to dividend payments. BAM earns base management fees from private funds, which are mostly contracted and predictable. As an asset-light alternative manager, BAM distributes more of its earnings to shareholders than its parent company, Brookfield Corporation (BN).

Following the spin-off, BAM’s initial dividend of $0.32USD/share paid quarterly increased to $0.38USD/share, a generous 19% hike!

Lastly

The new BAM is a pure play on alternative asset management. Interest in alternative assets is increasing, especially for institutional investors. It’s still early days, with only 18 months of results since becoming a pure asset-light manager. However, backed by the Brookfield family of companies and enjoying a lot of expertise, this large asset manager might be a very good play for patient investors. Also, with a dividend yield of 3.8, it fits well in many investors’ portfolios.

success internationally but had to close its Italian division and continues to struggle in India. However, after closing its Italian business, the company focused on what’s working for it in North America.

success internationally but had to close its Italian division and continues to struggle in India. However, after closing its Italian business, the company focused on what’s working for it in North America.

Its projects under construction include over 140 MW of renewable generation capacity and 512 MW of incremental natural gas combined cycle capacity from the repowering of Genesee 1 and 2 in Alberta. It has over 350 MW of natural gas and battery energy storage systems in Ontario and approximately 70 MW of solar capacity in North Carolina in advanced development. Its La Paloma facility is in Kern County, California. The Company also has a natural gas generation facility in the Harquahala region of Arizona.

Its projects under construction include over 140 MW of renewable generation capacity and 512 MW of incremental natural gas combined cycle capacity from the repowering of Genesee 1 and 2 in Alberta. It has over 350 MW of natural gas and battery energy storage systems in Ontario and approximately 70 MW of solar capacity in North Carolina in advanced development. Its La Paloma facility is in Kern County, California. The Company also has a natural gas generation facility in the Harquahala region of Arizona.

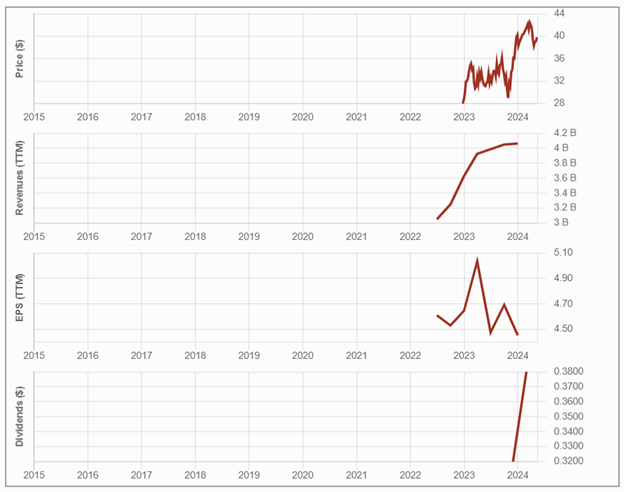

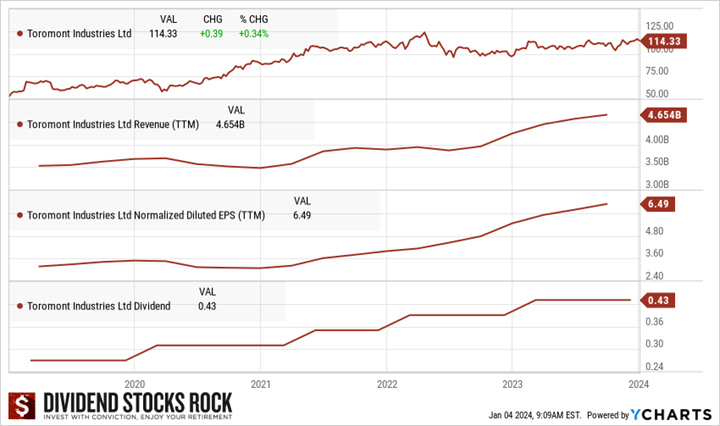

Toromont Industries is a Canada-based company serving the specialized equipment and lifetime product support needs of thousands of customers in diverse industries from roadbuilding to mining, and telecommunications to food and beverage processing. It operates the Equipment Group and CIMCO segments.

Toromont Industries is a Canada-based company serving the specialized equipment and lifetime product support needs of thousands of customers in diverse industries from roadbuilding to mining, and telecommunications to food and beverage processing. It operates the Equipment Group and CIMCO segments.

BN is the parent company of the other Brookfield companies; through them BN focuses on long-life, high-quality assets including: Renewable Power & Transition assets in hydro, wind, solar, distributed energy and sustainable solutions; Infrastructure assets in transport, data, utilities and midstream sector; Asset Management, managing funds coming from pension plans and other investors; Private Equity, businesses that provide essential industrial, infrastructure, and business services; Real Estate with a diversified portfolio across many industries and spread across five continents; Credit, through its majority interest in Oaktree; and Insurance Solutions across the life, annuity, and property and casualty industries.

BN is the parent company of the other Brookfield companies; through them BN focuses on long-life, high-quality assets including: Renewable Power & Transition assets in hydro, wind, solar, distributed energy and sustainable solutions; Infrastructure assets in transport, data, utilities and midstream sector; Asset Management, managing funds coming from pension plans and other investors; Private Equity, businesses that provide essential industrial, infrastructure, and business services; Real Estate with a diversified portfolio across many industries and spread across five continents; Credit, through its majority interest in Oaktree; and Insurance Solutions across the life, annuity, and property and casualty industries.