If you’re looking for ways to maximize returns and build long-term wealth, consider dividend reinvestment plans (DRIPs). Reinvest your dividends in the underlying stock automatically, compounding your investment over time.

In this article, we’ll delve into what DRIPs are, how they work, how investors can participate, and the advantages and inconveniences associated with them.

What are DRIPs?

Dividend reinvestment plans (DRIPs) are an investment tool that allows shareholders to reinvest cash dividends received from a company’s stock into more shares or fractions of shares. Instead of receiving dividends in the form of cash payouts, investors automatically reinvest those dividends into the same stock. The result? Investors accumulate more shares over time, without any effort, and save themselves transaction costs along the way.

Dividend reinvestment plans (DRIPs) are an investment tool that allows shareholders to reinvest cash dividends received from a company’s stock into more shares or fractions of shares. Instead of receiving dividends in the form of cash payouts, investors automatically reinvest those dividends into the same stock. The result? Investors accumulate more shares over time, without any effort, and save themselves transaction costs along the way.

How Do DRIPs Work?

When a company pays dividends, instead of receiving a cash payment, shareholders who participate in a DRIP program receive shares equivalent to the value of the dividends. These shares are bought directly from the company without brokerage fees. Sometimes, DRIP participants get the stock at a discounted price.

For example, suppose you own 100 shares of Company X, and each share pays a quarterly dividend of $1. The stock price is $25 per share. If you take part in Company X’s DRIP program, instead of receiving $100 in cash dividends, you will receive 4 shares. Over time, this reinvestment can significantly increase your holdings in Company X.

Don’t miss anything! Subscribe to our free newsletter here!

Enrollment and Participation

Participating in a DRIP program is relatively straightforward. Usually, investors must own at least one share of the company’s stock to enroll in the plan. They can do so directly through the company’s transfer agent or brokerage firm, depending on the availability of the DRIP program. Once enrolled, dividends are automatically reinvested without requiring any further action from the investor.

Many brokerage firms offer DRIP services to their clients, making it convenient for investors to enroll in multiple DRIP programs through a single platform. Investors can usually manage their DRIP participation online, track their dividend reinvestments, and monitor their growing investment portfolios.

Note that not all companies offer DRIPs. Consult the Investor Relations section of a company’s website to see whether they have a DRIP. Brokerage firms will also have a list of company DRIPs you can enroll in.

Advantages of DRIPs

Compounding Returns

One of the main benefits of DRIPs is the power of compounding returns. By reinvesting dividends back into the underlying stock, investors buy more shares, which in turn generate more dividends. Over time, this compounding effect can significantly enhance the total return on investment.

Dollar-Cost Averaging

DRIPs provide investors with the advantage of dollar-cost averaging. Since dividends are reinvested regularly, regardless of market conditions, investors buy more shares when prices are low and fewer shares when prices are high. This disciplined approach helps smooth out the impact of market volatility and can result in a lower average cost per share over time.

Convenience

DRIPs automate the process of reinvesting dividends, eliminating the need for investors to actively manage their dividend income. This automation makes it convenient for investors to grow their investment portfolios without requiring constant attention or manual intervention.

Potential Cost Savings

Many DRIP programs offer the option to buy additional shares at a discounted price or without incurring brokerage fees. This can lead to cost savings for investors, especially those who regularly reinvest dividends and accumulate shares over the long term.

Don’t miss anything! Subscribe to our free newsletter here!

Drawbacks of DRIPs

While DRIPs offer several advantages, they can complicate tax reporting for investors. In non-registered accounts, reinvested dividends are still considered taxable income, even though they are not received in cash. Investors need to keep track of their reinvested dividends and report them accurately on their tax returns, which may require more record-keeping and tax preparation efforts.

Participating in a DRIP program means relinquishing control over dividend payments. While automatic reinvestment can be helpful for long-term investors, it may not suit those who prefer to receive cash dividends for other purposes, such as funding living expenses or investing in other stocks.

In some cases, companies issue new shares to fulfill the demand for DRIP participants, which dilutes existing shareholders’ ownership stakes. The effect of dilution might be minimal for large, established companies, but it could be more significant for smaller companies with fewer outstanding shares.

To DRIP or not to DRIP

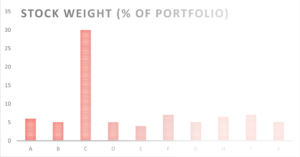

Participating in a DRIP increases investors’ positions in some stocks automatically without them having to lift a finger. Over time, you could end up with overweight positions for these stocks if you don’t monitor your portfolio.

Participating in a DRIP increases investors’ positions in some stocks automatically without them having to lift a finger. Over time, you could end up with overweight positions for these stocks if you don’t monitor your portfolio.

Also, if the stock price is on a major bull run and keeps rising, and your DRIP buys more for you with every dividend payment, your average cost per share rises as well. The point is that investors should watch their DRIP reinvestments, and the weight of the positions quarterly to avoid these issues. When a position reaches the maximum weighting wanted, it’s time to stop the DRIP to either cash in the dividends or invest them in other stocks.

Investors getting near retirement should also remember to review their DRIPs and stop some or all of them to help build up their cash reserve with the cash dividends ahead of the start of their retirement. Find out more about this in Retirement Cash Reserve: Surf the Market’s Waves.

Conclusion

Dividend reinvestment plans (DRIPs) are a compelling tool for investors to grow their investment portfolios over the long term. By reinvesting dividends back into the underlying stock, investors can harness the power of compounding returns and dollar-cost averaging to maximize their wealth accumulation.

While DRIPs provide numerous advantages, including automation, cost savings, and compounding benefits, investors should also be mindful of the potential tax implications, lack of flexibility, and the risk of dilution associated with taking part in DRIP programs. Investors must also monitor the weight of positions for which they participate in a DRIP and stop the DRIP when the positions are large enough and when they want to build their retirement cash reserve.

Ultimately, the decision to enroll in a DRIP should align with investors’ long-term financial goals, risk tolerance, and investment preferences.

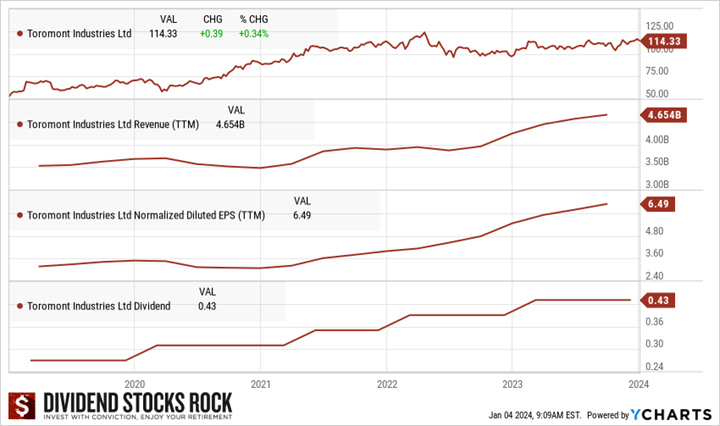

Toromont Industries is a Canada-based company serving the specialized equipment and lifetime product support needs of thousands of customers in diverse industries from roadbuilding to mining, and telecommunications to food and beverage processing. It operates the Equipment Group and CIMCO segments.

Toromont Industries is a Canada-based company serving the specialized equipment and lifetime product support needs of thousands of customers in diverse industries from roadbuilding to mining, and telecommunications to food and beverage processing. It operates the Equipment Group and CIMCO segments.

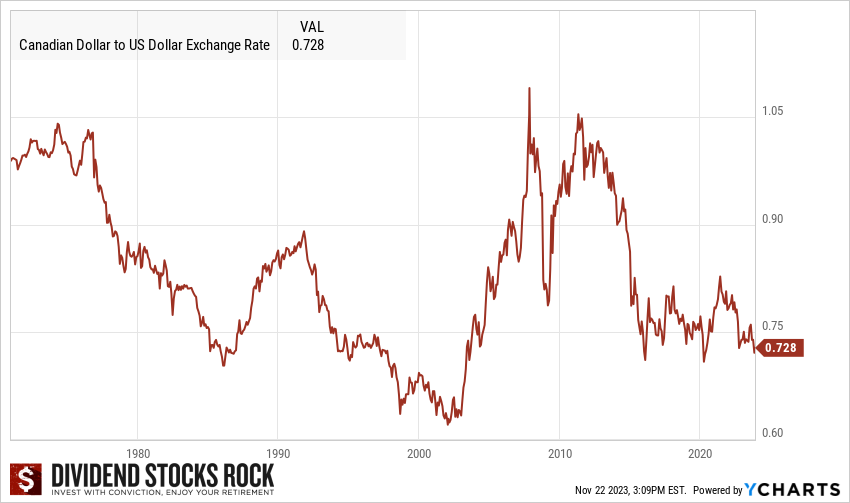

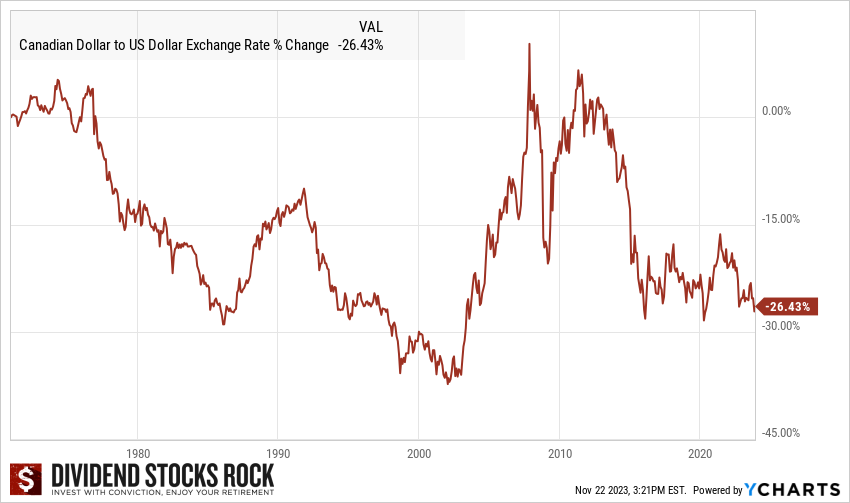

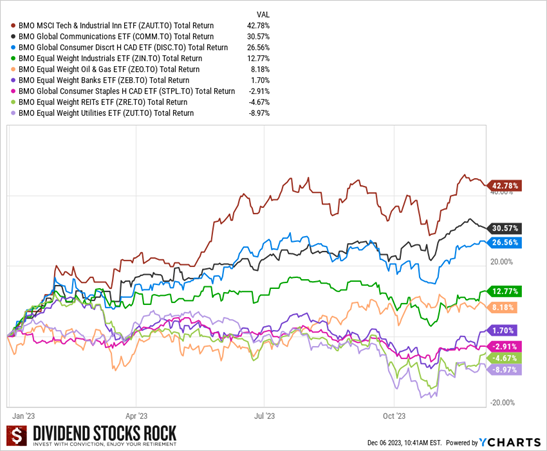

Canadian stocks paying USD dividends or trading on an U.S. market (either the NYSE or NASDAQ), or both. Why? Canadian dividend stocks are fascinating. Many of them operate in small niches and pay handsome dividends.

Canadian stocks paying USD dividends or trading on an U.S. market (either the NYSE or NASDAQ), or both. Why? Canadian dividend stocks are fascinating. Many of them operate in small niches and pay handsome dividends.

(BCE, TU, RCI, ): Like Canadian banks, telecoms operate in a small oligopoly where 90% of the wireless market is controlled by BCE, TU and RCI. BCE and TU are long-time dividend growers.

(BCE, TU, RCI, ): Like Canadian banks, telecoms operate in a small oligopoly where 90% of the wireless market is controlled by BCE, TU and RCI. BCE and TU are long-time dividend growers.  (TFII, CNI, CP,

(TFII, CNI, CP,  In general, the advantage of Canadian stocks paying a USD dividend is more for the company, because it generates most of its revenues in USD as explained earlier. For investors, it could be a source of headaches or frustrations (you don’t want your broker making a sweet 2% conversion rate fee on your dividend, right?). However, if you plan a vacation or retirement in the U.S., having Canadian stocks paying their dividend in Uncle Sam’s dollar is a natural hedge against currency fluctuation. You can build a part of your portfolio with those Canadian stocks along with other US stocks and you’ll be set to never have to worry about converting your money “at a bad rate” in the future.

In general, the advantage of Canadian stocks paying a USD dividend is more for the company, because it generates most of its revenues in USD as explained earlier. For investors, it could be a source of headaches or frustrations (you don’t want your broker making a sweet 2% conversion rate fee on your dividend, right?). However, if you plan a vacation or retirement in the U.S., having Canadian stocks paying their dividend in Uncle Sam’s dollar is a natural hedge against currency fluctuation. You can build a part of your portfolio with those Canadian stocks along with other US stocks and you’ll be set to never have to worry about converting your money “at a bad rate” in the future.

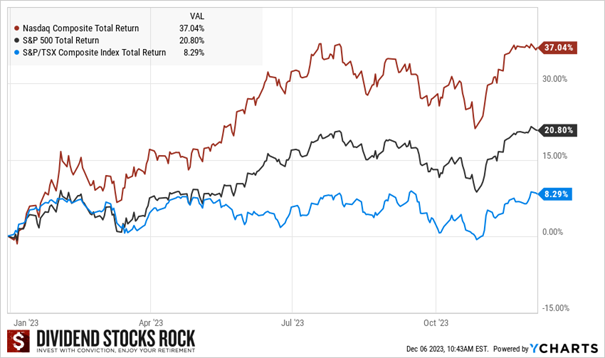

Studies show that most individual investors like you and me lag the market… big time. Think of famous investor Peter Lynch who managed the Fidelity Magellan Fund from 1977 to 1990 generating an annualized return of 29%. Fidelity later revealed that the average Magellan Fund investor lost money during this period. How is that possible? Investors were simply not investing with conviction, and they didn’t stick to their plan, especially at times when the market dropped.

Studies show that most individual investors like you and me lag the market… big time. Think of famous investor Peter Lynch who managed the Fidelity Magellan Fund from 1977 to 1990 generating an annualized return of 29%. Fidelity later revealed that the average Magellan Fund investor lost money during this period. How is that possible? Investors were simply not investing with conviction, and they didn’t stick to their plan, especially at times when the market dropped.