You’ve heard about the Canada Pension Plan (CPP), you see it on your income tax slips, you’ve paid into it. You know the CPP is a benefit you can start to collect in your 60s. Still, you might be a little hazy on the details.

- How much does the CPP pay?

- Who is eligible to receive CPP payments?

- Is it taxable?

You’ve also heard some people start to collect CPP when they turn 60 while others wait until the age of 70. Why? When is the best time to take it?

If you live in Québec, or have worked in Québec, you might have heard about the Québec Pension Plan (QPP, or RRQ in French). Is that different from the CPP?

Want to demystify the CPP? We do too. Here it is.

What is the Canada Pension Plan (CPP)?

Created in 1965, the Canada Pension Plan is retirement benefit payable to Canadians who have earned employment income and have paid contributions to the CPP. It was created to address growing poverty among retired Canadians.

The CPP is funded by contributions made by Canadian workers and their employers. The contributions are a percentage of the employees’ salary, up to a maximum yearly contribution. The employee contributions are withheld from the workers’ pay by employers. The Canada Pension Plan is one of the largest pension funds in the world.

The CPP is funded by contributions made by Canadian workers and their employers. The contributions are a percentage of the employees’ salary, up to a maximum yearly contribution. The employee contributions are withheld from the workers’ pay by employers. The Canada Pension Plan is one of the largest pension funds in the world.

The CPP covers all Canadian workers except those in Québec who are eligible for the equivalent Québec Pension Plan (QPP), also known in French as the RRQ.

Another retirement benefit for Canadians is Old Age Security. Read all about it here next week.

How much does CPP pay?

The amount of your monthly CPP payment depends on how long you have contributed to the Canada Pension Plan, how much you’ve paid into it, which is based on your salary, and at what age you begin to collect CPP.

As of January 2023, the maximum monthly payment someone can receive, when starting at age 65, is $1,306.57. The average monthly payment for people starting to receive CPP at 65 is $811.21.

You can see an estimate of the CPP amount you’ll receive, based on your contributions to date, on the Government of Canada website. If you are a Québec resident, you can see an estimate of your QPP on the Government of Québec website.

Download our CPP & OAS Guide right now for easy instructions for accessing your estimate.

Who is eligible to receive CPP payments?

Anyone who has contributed to the Canada Pension Plan during their life. You can begin receiving the CPP payment as early as age 60, and at age 70 at the latest.

Is the CPP payment taxable?

Yes, it is. There’s always something, isn’t there? For some help on that front, read our Retirement Tax Optimization Basics article.

Do the payments change over time for inflation?

The CPP payment is adjusted once a year, in January, based on the Consumer price index (CPI) All-Items Index.

Some people begin to receive CPP payments at 60, while others wait beyond age 65. Why?

The age at which you start receiving CPP affects the amount you receive. To make the decision, consider your retirement plans, health, and financial situation.

Taking CPP early, meaning before age 65, means your payment is reduced from what it would have been at age 65, by 0.6% for each month before your 65th birthday at the time you start receiving it.

For example, if you begin receiving the CPP when you turn 63, which is 24 months before your 65th birthday, your payment is reduced by 14.4% (24 months * 0.6%) from what you would have received had you waited until your 65th birthday.

For example, if you begin receiving the CPP when you turn 63, which is 24 months before your 65th birthday, your payment is reduced by 14.4% (24 months * 0.6%) from what you would have received had you waited until your 65th birthday.

On the other hand, if you delay receiving the CPP beyond age 65, the payment you receive increases by 0.7% for each month you delay. So, someone who begins receiving CPP when they turn 69, four years after turning 65, receives 33.6% (48 months * 0.7%) more than they would have at age 65.

Once you start receiving CPP payments, you cannot cancel. The payment you receive is set and will not change, other than the yearly review to account for the cost of living. In other words, there is no do-over; you can’t stop the payments and delay them to a later age to receive a higher amount.

Want to know more? Download our CPP & OAS Guide.

Why take CPP early?

Reasons for taking the CPP early include needing the income sooner than age 65, and having good reasons to believe you will not live to age 80, such as current health issues, lifestyle, or family history.

Some people take CPP early to have more money to enjoy life while they are young and active retirees; this can be the right choice, as long as they have enough savings or another pension to rely on in their later years to make up for their lower CPP amount.

Some people take CPP early to have more money to enjoy life while they are young and active retirees; this can be the right choice, as long as they have enough savings or another pension to rely on in their later years to make up for their lower CPP amount.

Who delays receiving CPP?

People who have significant savings, another pension plan, or both, as well as those who plan to keep working part of their 60s might also prefer to delay receiving CPP. In doing so, they’ll get a larger amount and better financial protection should they live to a very old age.

Remember, delaying receiving CPP to a time when your income will be lower also reduces the amount of tax you’ll pay on it.

This article doesn’t go deep into tax issues because each situation is different, with different applicable rules and tax rates. However, there are situations we all have in common upon retirement. After your retirement strategy is outlined, i.e., your global asset allocation, risk tolerance, types of investments, etc., you’re in a good position for some tax tweaking. Don’t do it the other way around.

This article doesn’t go deep into tax issues because each situation is different, with different applicable rules and tax rates. However, there are situations we all have in common upon retirement. After your retirement strategy is outlined, i.e., your global asset allocation, risk tolerance, types of investments, etc., you’re in a good position for some tax tweaking. Don’t do it the other way around. The best tax advice I can give you is quite simple: spend a few thousand dollars with a fee-based financial planner and an accountant. They’ll do the hard work and offer you a customized plan to optimize your taxes. Make your appointment, develop a plan, and avoid potentially costly mistakes.

The best tax advice I can give you is quite simple: spend a few thousand dollars with a fee-based financial planner and an accountant. They’ll do the hard work and offer you a customized plan to optimize your taxes. Make your appointment, develop a plan, and avoid potentially costly mistakes. Some retirees are tempted to withdraw money from tax-sheltered accounts earlier to pay less tax, as they assume their marginal tax rate to be lower at 60 years of age than at 85, when they anticipate they’ll have to withdraw more money. However, when you withdraw money, you pay the taxes immediately. The money paid to the government can’t compound going forward. Withdrawing at a younger age means you miss out on years of growth on tax paid.

Some retirees are tempted to withdraw money from tax-sheltered accounts earlier to pay less tax, as they assume their marginal tax rate to be lower at 60 years of age than at 85, when they anticipate they’ll have to withdraw more money. However, when you withdraw money, you pay the taxes immediately. The money paid to the government can’t compound going forward. Withdrawing at a younger age means you miss out on years of growth on tax paid.

Throughout your retirement, you’ll go through bull and bear markets. During a bear market, selling shares to generate your homemade dividend could hurt your retirement plan.

Throughout your retirement, you’ll go through bull and bear markets. During a bear market, selling shares to generate your homemade dividend could hurt your retirement plan.

$20,000 for 1 year at 3%

$20,000 for 1 year at 3%

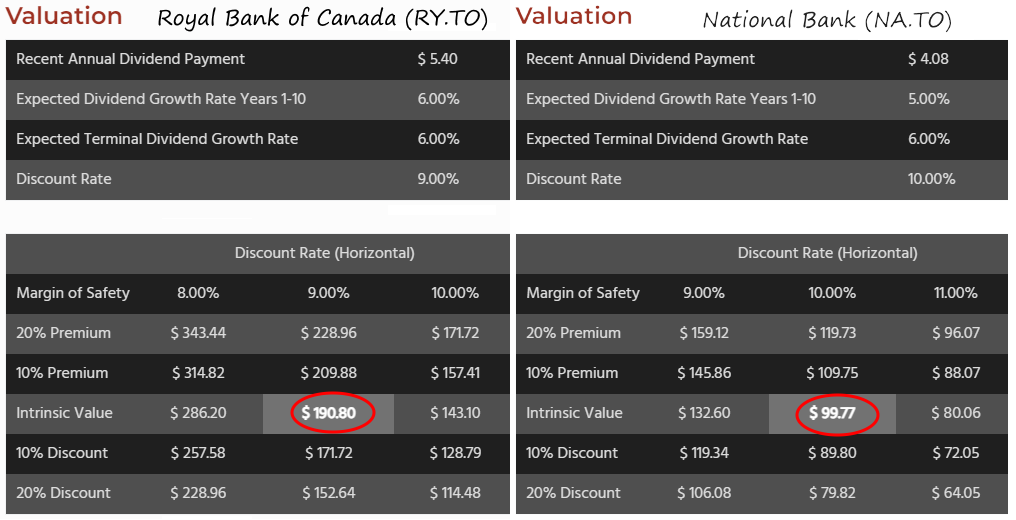

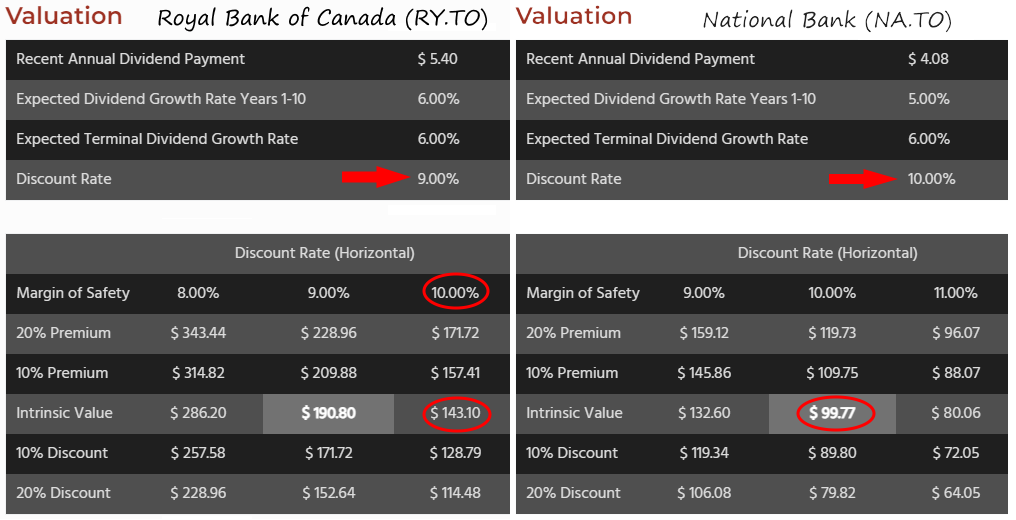

I don’t use valuation to determine if the company is undervalued or not because, to be honest, your guess is as good as mine. If you put ten financial analysts in a room and ask them to determine the valuation of a company, you’ll likely end up with ten materially different answers.

I don’t use valuation to determine if the company is undervalued or not because, to be honest, your guess is as good as mine. If you put ten financial analysts in a room and ask them to determine the valuation of a company, you’ll likely end up with ten materially different answers.

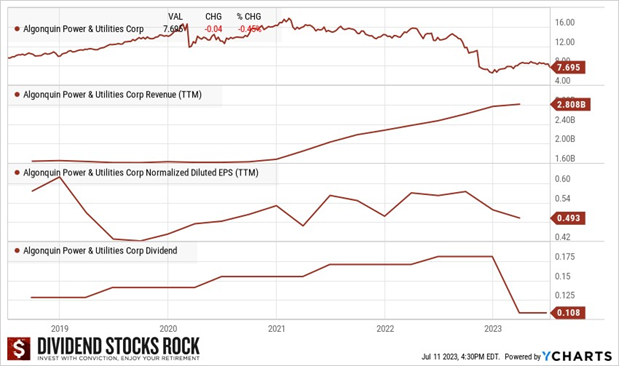

Now comes the fun part. I identify potential risks and growth prospects for each company. It’s important to be realistic and not get carried away by the positive aspects. I look at growth trends to see if they’re slowing down, review the evolution of company debt over the years, and consider potential downsides like vulnerability to inflation, interest, regulation, patent expiry, and competition. I read up on bear theses to understand why some investors might dislike a company. It’s important to know what I’m getting into and to be prepared for any challenge that may arise.

Now comes the fun part. I identify potential risks and growth prospects for each company. It’s important to be realistic and not get carried away by the positive aspects. I look at growth trends to see if they’re slowing down, review the evolution of company debt over the years, and consider potential downsides like vulnerability to inflation, interest, regulation, patent expiry, and competition. I read up on bear theses to understand why some investors might dislike a company. It’s important to know what I’m getting into and to be prepared for any challenge that may arise.