Lumber stocks usually run hot with housing booms and crash just as fast. But not this one. This Canadian company built its business around utility poles and railway ties — essential infrastructure that keeps cities powered and freight moving. In a sector known for wild swings, this one offers surprising consistency (and a few earnings surprises too).

Business Model: Where Wood Meets Infrastructure

Most investors hear “lumber” and think housing starts, sawmills, and cyclical chaos. However, Stella-Jones (SJ.TO) took a different route — it built its business around utility poles and railway ties, two products that are essential in modern infrastructure.

Instead of chasing construction booms, Stella-Jones established long-term supply relationships with power utilities, telecommunications companies, and railroads. These customers aren’t just placing one-time orders — they come back again and again for maintenance, upgrades, and replacements. That’s the kind of stability we like to see in a dividend-paying company.

Here’s what Stella-Jones focuses on:

-

Utility poles for electrical and telecommunications grids

-

Railway ties for short lines and commercial railroads across North America

-

Industrial wood products are used in bridges, marine pilings, and foundations

-

Residential treated lumber, primarily sold through Canadian retailers

With over 70% of revenue coming from poles and ties, Stella-Jones sits in a unique niche: boring, essential, and high-repeat. Sounds like a recipe for reliable cash flow.

Investment Thesis: Stable Demand, Smart Expansion

Stella-Jones isn’t your typical lumber stock. It built its business around utility poles and railway ties, supplying essential infrastructure with steady, repeat demand. These are not one-time purchases — they’re part of long-term maintenance cycles for utilities and railroads.

This provides SJ with a reliable customer base and predictable cash flow, even when residential construction slows. Its clients — power companies, telecoms, and railroads — don’t delay upgrades when interest rates rise.

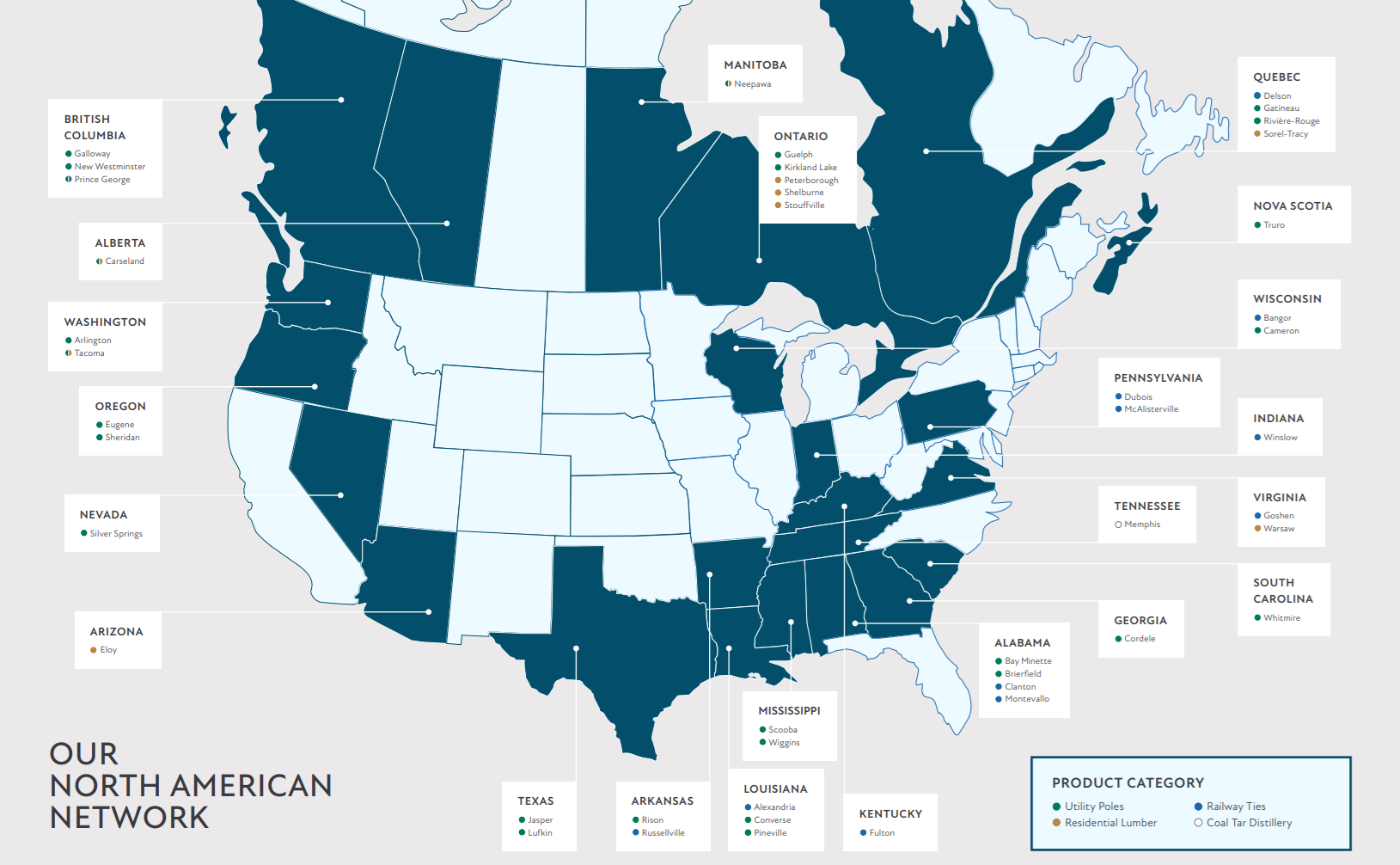

Additionally, management has executed strategic acquisitions effectively, expanding its North American footprint in a fragmented market. With its core products tied to infrastructure — not housing — Stella-Jones offers steady growth potential backed by disciplined operations and rising margins.

Build a Smarter, Safer Dividend Portfolio

Whether you’re looking for income today or wealth tomorrow, you need stocks that deliver on all three parts of the Dividend Triangle.

That’s precisely what the Dividend Rock Star List is built for:

-

No fluff — just fundamentally strong dividend stocks

Includes both Canadian and U.S. dividend payers

-

Easily sort by dividend growth rate, payout ratio, and more

-

Updated every month — no stale picks, no guesswork

Use it to build your watchlist, strengthen your portfolio, or start fresh with confidence.

Explore the Dividend Rock Star List now:

The Dividend Triangle in Action: Solid, Steady, and Sharpening Margins

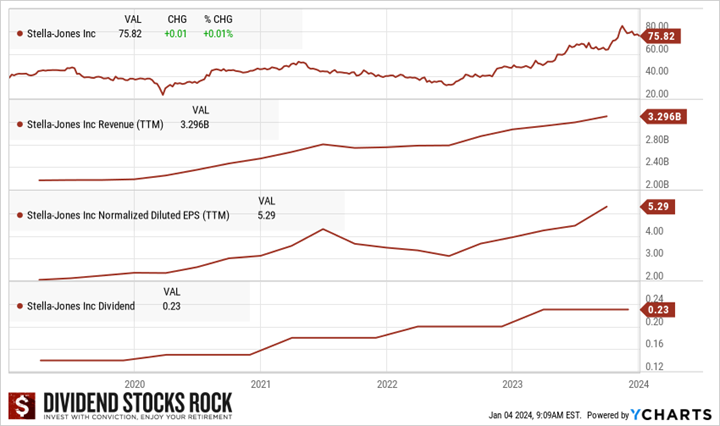

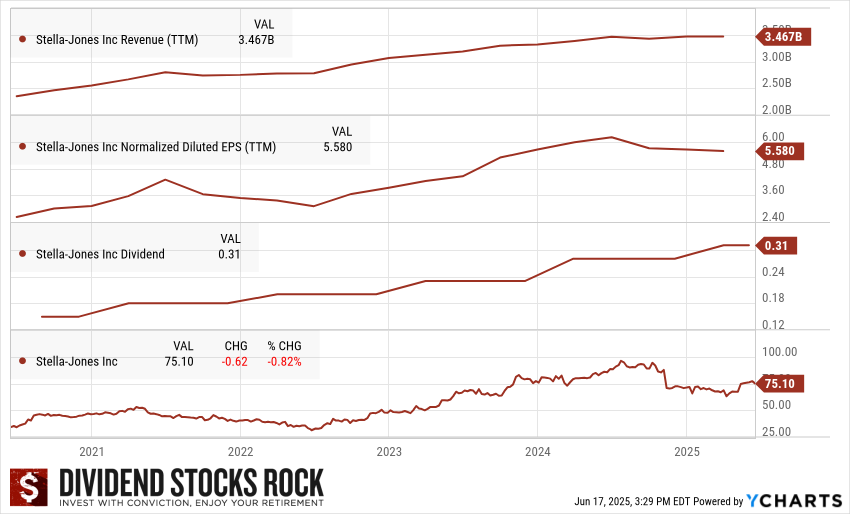

Looking at Stella-Jones through the Dividend Triangle lens reveals exactly why it stands out in a volatile sector:

1. Revenue Growth: Revenue reached $3.467B, showing a stable, upward trajectory since 2021. While growth has flattened recently, the trend remains positive, particularly in infrastructure-facing segments like utility poles and industrial products.

2. Earnings Growth: EPS sits at $5.58, up firmly from 2021 levels. Despite fluctuations in specific segments, SJ has improved its margin profile through disciplined cost management and pricing power — especially visible in the latest 23% jump in EPS.

3. Dividend Growth: The dividend increased to $0.31, representing a nearly doubling since 2021. While still modest in yield, it reflects a sustainable and consistent payout strategy, backed by stable cash flows and a conservative payout ratio.

Summary: SJ delivers on all three fronts. Even when revenues stall (as seen in the latest quarter), earnings and dividends continue to rise, signaling healthy operations and a resilient business model.

Bull Case: Built-In Repeat Business

There’s a lot to like here for investors who value stability and recurring demand. Consider the following:

-

Over 70% of sales from utility poles and railway ties = repeat demand

-

Clients include utilities and railroads that replace wood regularly

-

Growing U.S. presence and acquisition strategy support long-term growth

-

Low payout ratio = dividend growth runway

This isn’t a timber boom stock. It’s an infrastructure business disguised as a lumber company.

Bear Case: Macro + Tariffs = Wild Swings

Still, the company isn’t without its risks — and some of them could hit hard in a volatile year:

-

Revenue can get hit by currency fluctuations or sudden order shifts

-

One Class 1 railroad started producing its own ties — not great

-

The residential lumber business still relies on housing demand

-

Volatile stock: Double-digit daily moves aren’t rare, especially with tariff concerns brewing

Investors should expect bumps along the way — even if the long-term story looks solid.

Latest News: Flat Top Line, Fat Bottom Line

The latest quarter had a little bit of everything:

-

Revenue flat, but $38M FX headwind masked real progress

-

Utility poles +4% thanks to pricing power

-

Railway ties -8% due to client production shift

-

Residential lumber stable

-

EPS +23%, helped by insurance gains and leaner operations

In short: management delivered higher profits even without growth fireworks. That’s how you win long-term.

Want More Stocks Like This One?

The Dividend Rock Star List is our hand-picked collection of quality dividend stocks.

Here’s what you’ll find inside:

-

🔍 Over 300 U.S. and Canadian dividend-paying stocks

-

✅ Screened using our Dividend Triangle: Revenue growth, EPS growth, and dividend growth

-

🚨 Updated monthly with the latest data

-

📊 Filter by yield, sector, payout ratio, dividend growth rate, and more

-

💡 Discover reliable growers that can power your portfolio through bull and bear markets

Start browsing the Dividend Rock Star List now and find your next winner before everyone else does.

Final Word: You’re Not Buying a Lumber Company. You’re Buying a Utility Supplier

Stella-Jones isn’t sexy. It’s not flashy. But it is essential.

Between utility poles, railway ties, and disciplined execution, SJ has carved out a strong niche in a cyclical space. If you’re looking for dividend growers that do the job year after year — not just when lumber prices spike — this name should be on your radar.

Just don’t expect it to sit still. Volatility is part of the deal. Growth, however, is still on the table.