The world needs energy to function and the best energy companies are rewarding shareholders handsomely this year. The oil & gas industry has been fascinating investors for several decades. I guess this is due to the thrill coming from the next exploration results or an oil boom pushing stocks to record levels.

Where to find the best Oil & Gas Energy Stocks?

First, one must understand the differences across sub-sectors and activity types. The oil & gas industry is usually divided into three activities:

Upstream: This term represents all activities related to exploration and production. This is usually the phase where the commodity price is the most important. Companies will establish their financial projections based on a specific price (or cost) per barrel. Then, they will decide to explore (drill wells) or not depending on the likelihood of profitable operations.

Midstream: Midstream activities include the processing, storing, and transporting of oil & gas and their byproducts. This is where you will find pipeline-related businesses. The transportation and storage activities are usually more stable as they usually operate on long-term contracts with producers.

Downstream: this is the final step of the process including refining (to produce gasoline for example) and marketing the product (selling it to the end-customer). Don’t just think about gasoline, but all the other modified products such as liquefied natural gas, heating oil, synthetic rubber, plastics, lubricants, antifreeze, fertilizers, and pesticides

Sub-Sector (Industry)

| Oil & Gas Drilling | Oil & Gas Midstream |

| Oil & Gas E&P | Oil & Gas Refining & Marketing |

| Oil & Gas Equipment & Services | Thermal Coal |

| Oil & Gas Integrated | Uranium |

Energy Stocks Greatest strengths

Oil & gas stocks will raise passions and attract many investors during bull markets (especially after the boom in 2021). As the economy grows, demand for such products increases accordingly. Commodity prices go up, profits are skyrocketing, and dividends are generous. The problem is that it rarely stays that way.

The energy sector can generate great returns in your portfolio, but you will be required to follow this sector closely (and hopefully know what you are doing). If you can pick stocks during oil busts (as was the case back in March-April 2020), you will show double-digit (sometimes triple digit) returns. Since we do not employ a “buy and sell quickly” strategy, we rarely like energy stocks at DSR. They generally make unreliable dividend growers.

Finally, the energy sector is a great hedge against inflation. Along with other commodities, energy companies can easily pass price increases to their customers as it’s linked to supply vs. demand.

Energy Stocks Greatest Weaknesses

The energy sector is quite volatile and cyclical. This is not the best place to pick dividend growers. Many companies will attract investors with their high yield and generous promises, but they will eventually fail their shareholders. I’ve heard the best and the worst stories coming out of this sector. Therefore, it is crucial to do your homework prior to investing in the Energy sector.

The main problem with this sector is it is capital intensive and profits often depend on commodity prices. Companies have little to no control over the prices they receive for their oil or natural gas. Therefore, they spend billions on projects and hope the end price will remain profitable for several years.

Vertically integrated companies (upstream, midstream, and downstream) tend to maintain their dividend payments no matter what, but it is still a risky business. For example, BP (BP) had to cut its dividend after a major oil spill. Royal Dutch Shell (RDS.A or RDS.B) and Suncor (SU.TO / SU) also cut their distributions following the oil debacle in 2020.

As technology evolves, our demand for energy stagnates while our production capacity improves. In other words, don’t expect natural gas prices to rise anytime soon. All factors are combined to keep them at a low level.

How to get the best of it

The energy sector is the most cyclical of all. If you are courageous enough to ride the roller coaster, you can grab shares at highly depreciated prices every few years. If you would rather stay focused on a dividend growth investing strategy as we do here at DSR, you must be incredibly picky before investing a penny in this sector.

I prefer pipelines (midstream industry) as the most interesting opportunity in the energy sector. Pipelines are capital intensive and exposed to regulators and potential oil spills, but they also act as toll roads. The world needs energy and pipelines are the ones providing it.

This sector is more suitable for a growth investor. If you are retired and looking to enjoy a peaceful retirement, you may want to ignore this sector completely.

Target sector weight: Since this sector doesn’t offer the best dividend growers in town, I’d say that a 5% exposure should be enough (unless you like roller coasters!).

Best Energy Stocks to buy in September 2022

As a part of the hype around energy, stocks has faded, there are some great opportunities in this sector.

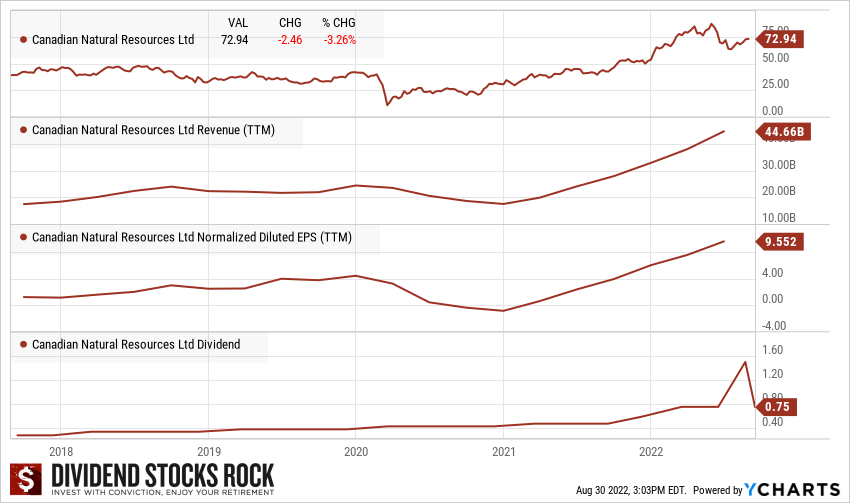

Canadian Natural Resources (CNQ.TO)

In a world where the West Texas Intermediate (WTI) trades at $75+ per barrel, CNQ would be a terrific investment (here is your cue since the WTI is trading way over $70 lately!). It is sitting on a large asset of non-exploited oilsands and reaches its breakeven point at a WTI of $35. What cools our enthusiasm is the strange direction oil has taken along with the fact that oilsands are not exactly environmentally friendly. Many countries are looking at producing greener energy and electric cars. This could slow CNQ’s ambitions. However, CNQ is very well positioned to surf any oil booms. The stock price has more than doubled in value since the fall of 2020. It has previously invested very heavily, and it is now generating higher free cash flow because of past capital spending. CNQ exhibited resiliency in 2020, and this merits a star in their book. This is also why it’s part of our Canadian Rockstars List!

Dividend Growth Perspective

On top of an impressive dividend growth streak of over 20 years, CNQ has recently shifted gears with highly generous dividend increases (another 28% in 2022!). CNQ has proven the resiliency of its business model and confirmed its ability to be a strong dividend grower. This is truly impressive. Now that the oil market has strengthened, CNQ should be able to generate healthy cash flows for years to come.

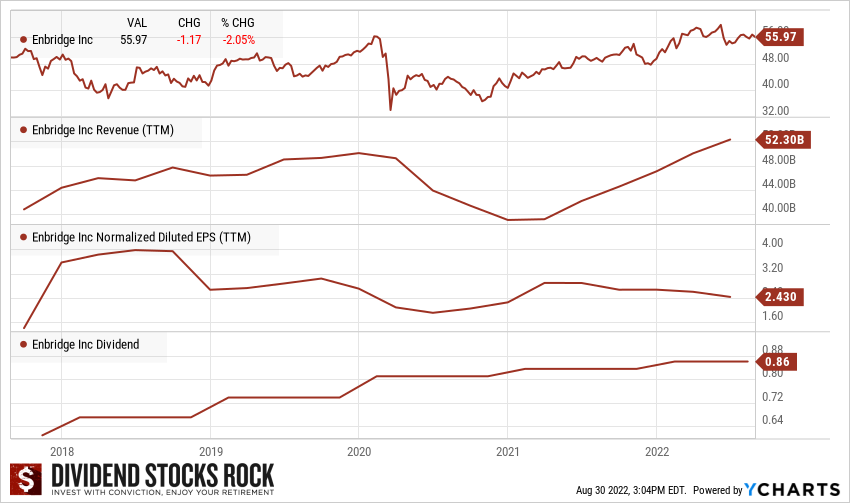

Enbridge (ENB.TO)

ENB’s customers enter 20-25-year transportation take or pay contracts. This means that ENB profits regardless of what is happening with commodity prices. ENB is also well positioned to benefit from the Canadian Oil Sands as its Mainline covers 70% of Canada’s pipeline network. As production grows, the need for ENB’s pipelines remains strong. Following the merger with Spectra, about a third of its business model will come from natural gas transportation. Enbridge has a handful of projects on the table or in development. It must deal with regulators, notably for their Line 3 and Line 5 projects. Both projects are slowly but surely developing. The cancellation of the Keystone XL pipeline (TC Energy) secures more business for ENB for its liquid pipelines. ENB now has a “greener” focus with its investments in renewable energy.

Dividend Growth Perspective

The company has been paying dividends for the past 65 years and has 27 consecutive years with an increase. Further dividend growth shouldn’t be as generous as compared to the past 3 years (10%/year). Management aims at distributing 65% of its distributable cash flow, leaving enough room for CAPEX. Look to their latest quarterly presentation for their payout ratio calculation. Management expects distributable cash flow growth of 5-7% annually. Therefore, you can expect a similar dividend growth rate. We have used more conservative numbers in our DDM calculation that are more in line with the 2021 and 2020 dividend increases of 3%. Here’s more about Enbridge’s dividend safety:

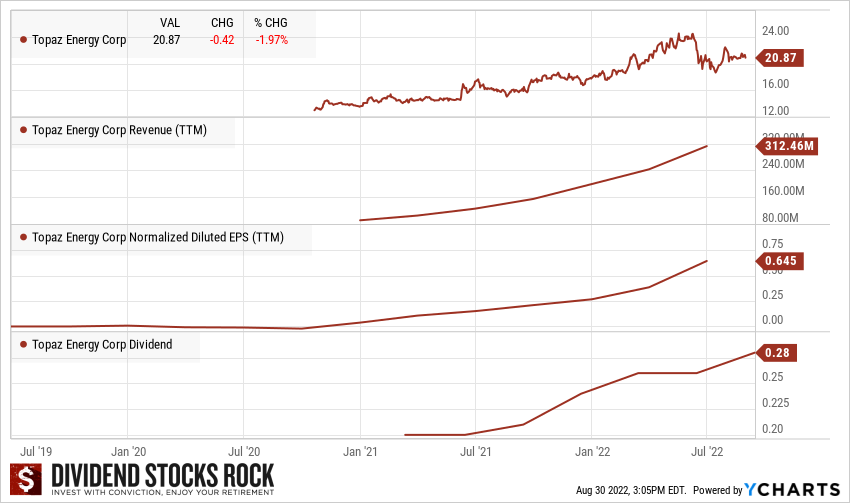

Topaz Energy Corp (TPZ.TO)

The company arrived on the market at the perfect moment (2021). Topaz was established through its key counterparty, Tourmaline Oil Corp (TOU.TO), from whom Topaz acquired its formative royalty and energy infrastructure assets in November 2019. Bolstered from this opportunity, Topaz now focuses on growth by acquisition to diversify its business model away from Tourmaline. In 2022, Liquid-rich natural gas royalties (paid by Tourmaline) should represent 50% of Topaz’s revenue. It will also count on conventional liquids royalties (~25%) and revenue coming from its infrastructure (25%). On top of acquisitions, we expect Topaz to exhibit strong organic growth as there are more projects being developed on their land. We appreciate the midstream business infrastructure projects representing 78% of revenues as they are based on take-or-pay contracts. This secures a portion of cash flow and brings more stability to a highly cyclical sector.

Dividend Growth Perspective

Topaz is a new company paying a new dividend and that makes it hard to predict what will happen next. The company has already increased its dividend several times, going from $0.21/share in 2021 to $0.26/share in early 2022, for a 24% total increase in less than 12 months. Free cash flow per share continues to increase by double-digits as Topaz surfs a strong oil & gas market. For 2022, management is confident that it will be able to increase its dividend by 8% while keeping its payout ratio within its target range of 60% to 90%.

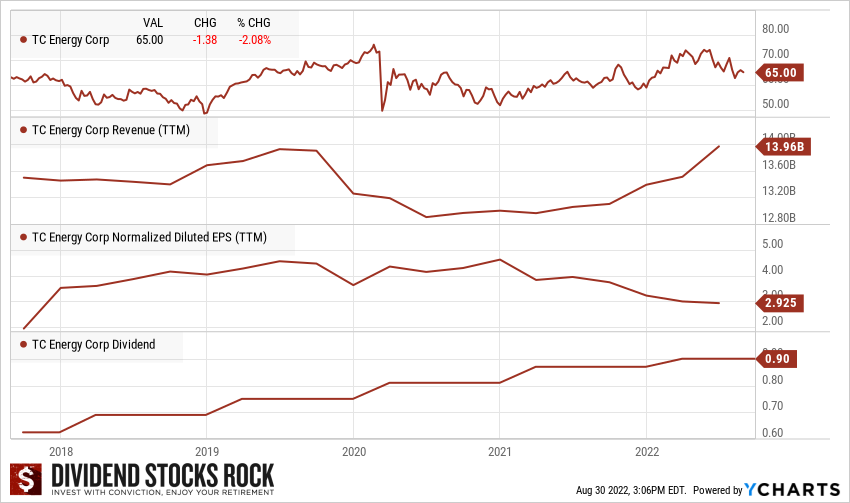

TC Energy (TRP.TO)

TRP is making use of large amounts of capital to fuel its growth over the coming years. Its acquisition of the Columbia pipeline and its extension toward Mexico are just two examples of what is to come. The company recently funded $4.5B for its Southeast Gateway Pipeline project to compliment TRP’s existing natural gas footprint in Mexico. It enjoys long-term contracts (of an average of 14 years), which provide great cash flow stability over time. The pipepeline’s growth potential remains in its natural gas pipeline expansion. TRP is a good candidate for long-term investment. As is the case with Enbridge, an investor must make sure to track TRP’s rising debt level. The company has kept its focus on rewarding shareholders with generous dividend increases, and that focus should continue. Unfortunately, management revised its dividend growth policy at the end of 2021; it’s still generous, but it’s not what it used to be!

Dividend Growth Perspective

TRP has successfully increased its dividend annually since 2001. TRP exhibits a 5-year CAGR of 9% but management reviewed its intention to boost its payout by 3-5% CAGR going forward. This news disappointed the market toward the end of 2021. We haven’t changed our DDM calculations as we were already forecasting a 4% dividend growth rate before the announcement. The company’s growth is fueled by its massive investment program. At the current yield, this is a good candidate for a retirement portfolio.

Find Better Stocks on the Canadian market…

There are great stocks to buy in the Energy sector, but there is more on the Canadian market! Moose Markets presents you with the Canadian Dividend Rock Stars list: a selection of Canadian companies showing both income and growth. The Canadian Rock Stars List is a selection of the safest dividend stocks in Canada. Download the list for free here: