Dividend investing is not about sprinting ahead—it’s more about maintaining a steady pace that delivers reliable results over time. Think of it like a marathon runner: disciplined, consistent, and built to withstand the test of endurance. Some businesses mirror that approach perfectly, combining stable cash flows with long-term strategies that enable dividends to continue growing. For investors seeking both income and peace of mind, this kind of stability can be just as rewarding as high-growth stories.

A Business Anchored in Protection and Wealth

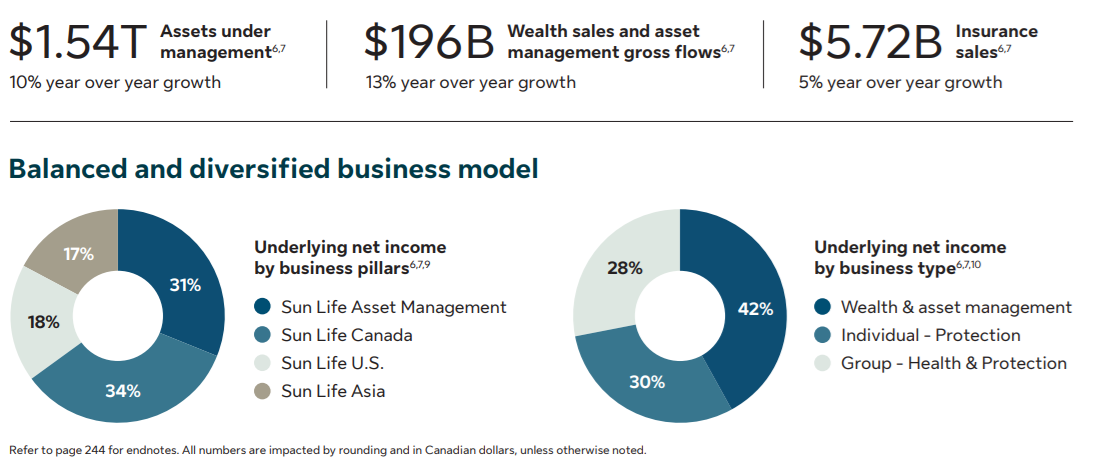

Sun Life (SLF.TO) operates across five key segments: Asset Management, Canada, U.S., Asia, and Corporate. Its business mix reflects three pillars:

-

Asset management & wealth – through MFS and SLC Management, which collectively oversee more than CAD 1 trillion in assets under management.

-

Group health & protection – providing benefits like dental, life, and disability insurance to employers and government programs.

-

Individual protection – traditional life and health insurance offerings sold directly to consumers.

In Canada, Sun Life dominates group insurance and retirement solutions. In the U.S., its acquisition of DentaQuest made it the #2 dental benefits provider. In Asia, it has tapped into high-growth markets where protection and wealth products are in demand. Together, these businesses create a diversified but competitive platform.

Building Growth Beyond Insurance

The Bull Case

Sun Life is not just an insurance company anymore—it’s an asset manager, a group benefits leader, and an international operator. Roughly 42% of its earnings now come from asset and wealth management, offering stable, fee-based cash flows that buffer against insurance volatility.

-

Asset Management Powerhouse – MFS and SLC Management continue to scale. SLC has been expanding into alternatives, which command higher fees and offer growth potential even in volatile markets.

-

Group Benefits Leadership – In Canada, Sun Life’s group insurance footprint is unmatched, supporting recurring revenues tied to employer coverage. In the U.S., its DentaQuest acquisition broadened its reach, adding long-term growth potential.

-

Asian Expansion – Sun Life has reported record net income from Asia, where demand for protection products and wealth solutions remains high. This region is an essential long-term growth vector.

-

Tailwinds from Rates – Rising interest rates improve yields on Sun Life’s large fixed-income portfolio, directly benefiting investment income.

Demographics are also working in Sun Life’s favor. An aging population in North America is fueling demand for retirement planning and protection products, while middle-class growth in Asia supports wealth and insurance demand.

The Bear Case

Despite its diversification, Sun Life faces familiar industry headwinds. Insurance remains a commoditized business, where pricing—not brand—is the main competitive factor. Asset management, while profitable, is vulnerable to market downturns and investor outflows.

-

Interest Rate Sensitivity – Rising rates provide a short-term boost, but prolonged low-rate environments in the past have shown how thin insurance margins can get.

-

Market Exposure – With over CAD 1 trillion AUM, market corrections would directly hit Sun Life’s fee income. MFS already reported challenges from lower average assets.

-

Competitive Pressures – In insurance, Manulife and Great-West Life are fierce rivals in Canada, while global giants dominate in the U.S. and Asia. In asset management, Sun Life is a fraction of the size of BlackRock or Vanguard, making pricing pressure a constant risk.

-

Political and Regulatory Risks – Like all insurers, Sun Life must navigate evolving regulations, particularly in health and retirement products. Any policy shifts could alter profitability in key regions.

While the company has shifted away from struggling U.S. life insurance operations, it still depends on execution in newer markets to keep growth alive.

Free Webinar Invite: Avoid Price Confusion and Act with Conviction

When a stock dives or spikes, most investors focus on the price. That’s the wrong move. In this live session, I’ll show you how to ignore the noise and interrogate the business—so you can decide with confidence whether to sell, hold, or buy more.

Thursday, September 18th at 1:00 p.m. ET

~50 minutes + 1-hour Q&A

Replay available for all registrants

Seats are limited to the first 500

You’ll discover:

-

A simple framework to know when to ignore headlines and when to act

-

A quick business-model check that surfaces real risks (fast)

-

How to use the Dividend Triangle to separate bargains from traps

Save your spot (or get the replay)

What’s New: Record Earnings from Asia and Mixed Trends Elsewhere

Sun Life’s latest quarter (August 20, 2025) showcased both strengths and challenges:

-

Core EPS up 13.5% year-over-year.

-

Asset Management & Wealth delivered $455M in net income (flat).

-

Group Health & Protection rose 7% to $326M.

-

Individual Protection surged 110% to $299M, rebounding from softer prior-year results.

-

Asia posted record earnings on strong protection growth and higher wealth contributions.

-

U.S. Dental saw gains from Medicaid repricing.

-

Canada benefited from favorable group life mortality but softer individual protection.

Overall, the quarter confirmed Sun Life’s ability to grow earnings across multiple levers, but also highlighted its exposure to market-linked asset management results.

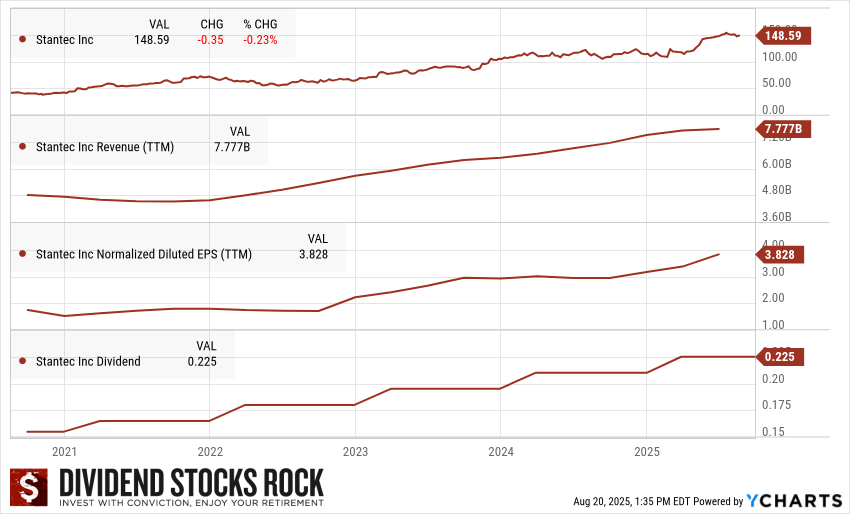

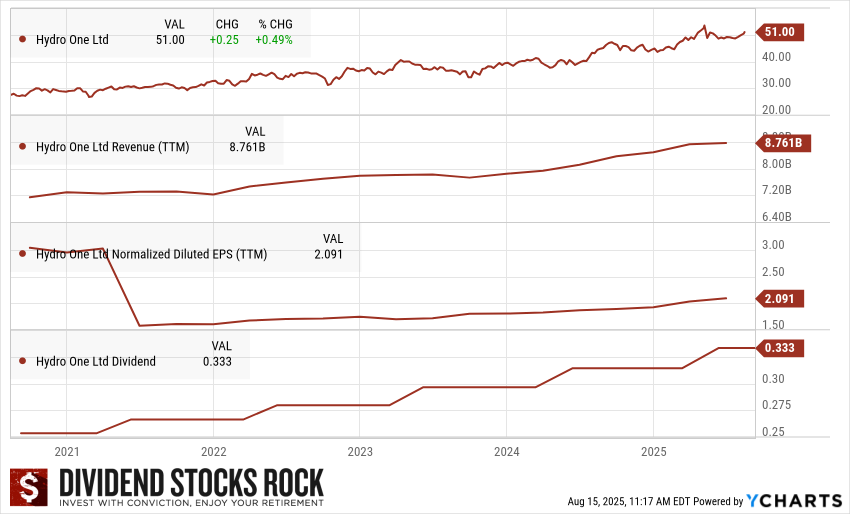

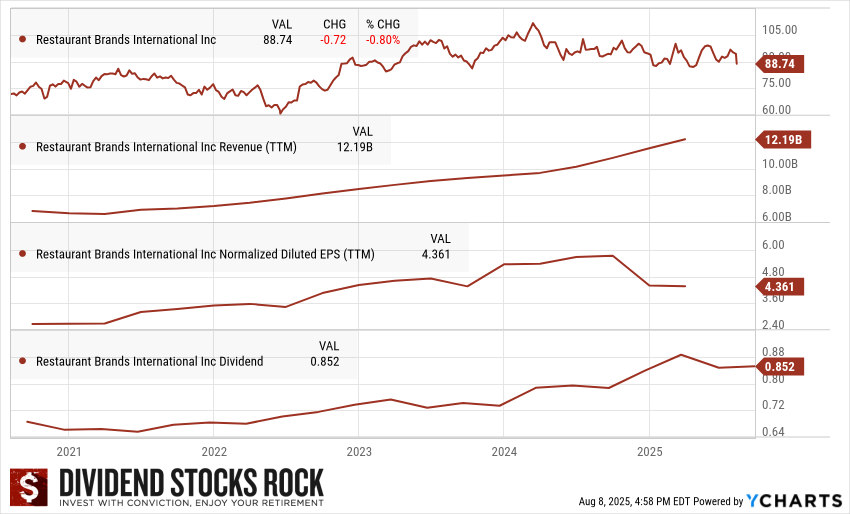

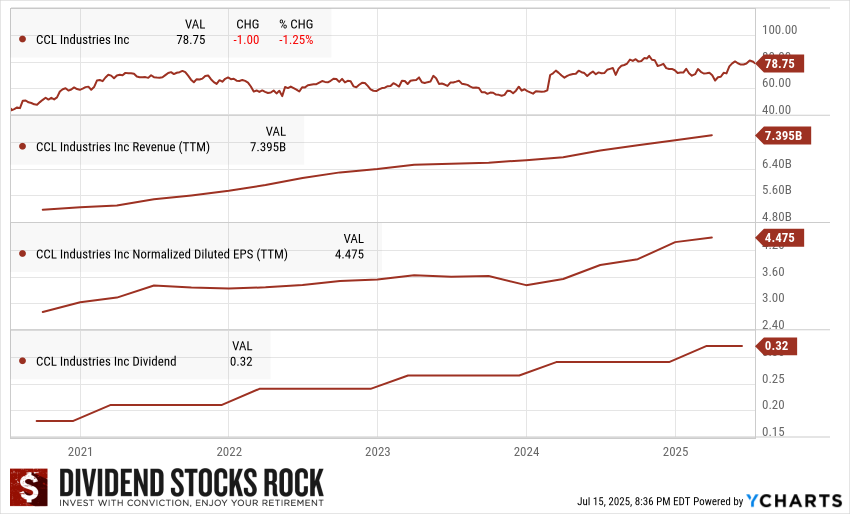

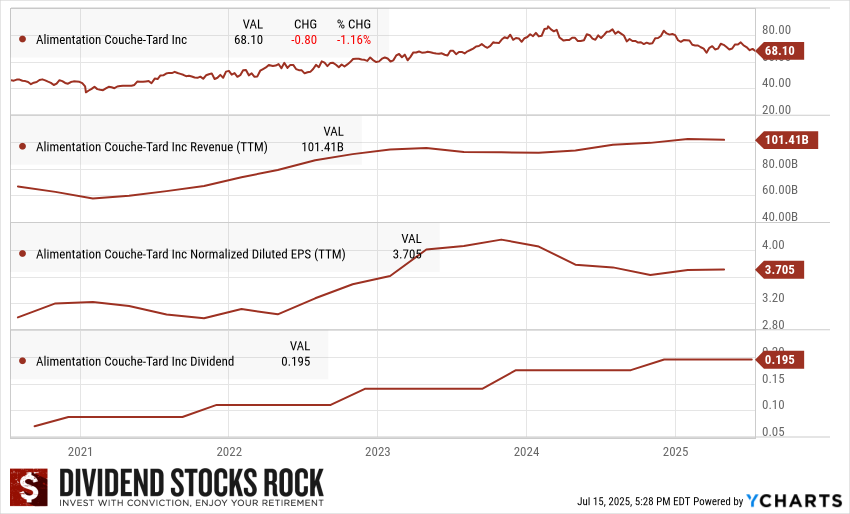

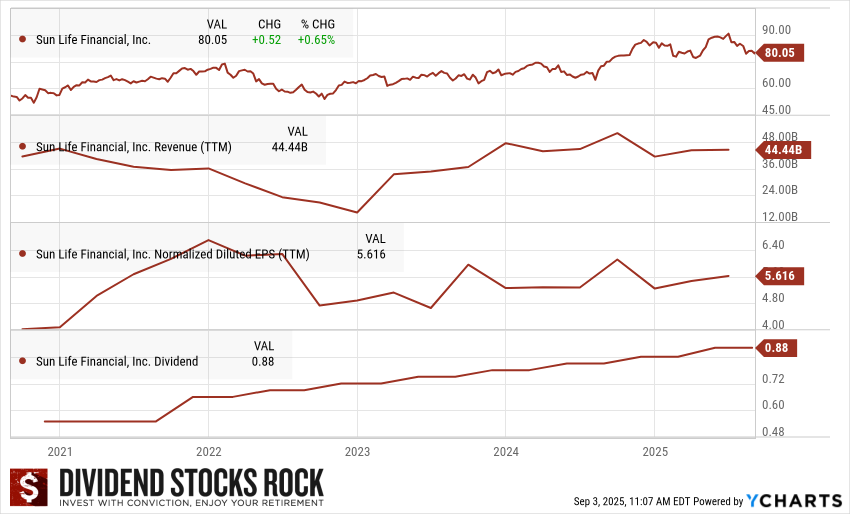

The Dividend Triangle in Action: Measured but Steady

The dividend story at Sun Life is one of consistency rather than excitement. Revenue and EPS have climbed steadily, though not spectacularly, while the dividend has marched upward in tandem.

-

Revenue: Stable, with gradual growth supported by asset management and group benefits.

-

Earnings per Share (EPS): Lumpy due to market-linked businesses, but the long-term trend remains positive.

-

Dividend: A modest yield, but with dependable growth—management increased the dividend by 6% in 2025.

This is not a high-yield stock, but rather a dividend grower that can serve as part of a balanced portfolio.

Final Thoughts: Dividend Growth that Endures

Some businesses are built for endurance rather than speed. This one has proven it can steadily grow earnings, manage through cycles, and reward shareholders along the way. With its mix of insurance, wealth, and asset management, it may not consistently deliver fireworks. Still, it offers something even more valuable for dividend investors: the confidence that your income can continue to grow year after year.

Free Webinar: Avoid Price Confusion

Stocks often jump or drop 10% on earnings day. How do you know if it’s time to buy, sell, or simply hold?

Join me on Thursday, September 18th, at 1:00 p.m. ET for a free session where I’ll share how to cut through the noise, check the business fast, and use the Dividend Triangle to spot real opportunities.