Many Canadians have used dividend investing to generate a stable source of income. But did you know you could increase this income? By writing covered call options on your holdings, you can boost your investment revenue. Since not all investors are comfortable writing options, financial firms have created covered call ETFs.

Covered call ETFs are dynamically managed funds that provide you exposure to dividend stocks on top of writing covered calls. This strategy generates additional revenue through the sale of each option. Therefore, you don’t need to worry about anything as a professional takes care to boost your investment yield.

While a dividend stock paying a yield above 5% could raise a red flag for many investors (there is no free lunch in finance), it’s relatively easy to find a safe covered call offering a better yield.

Let’s analyze three of the highest-yielding Canadian covered call on the market.

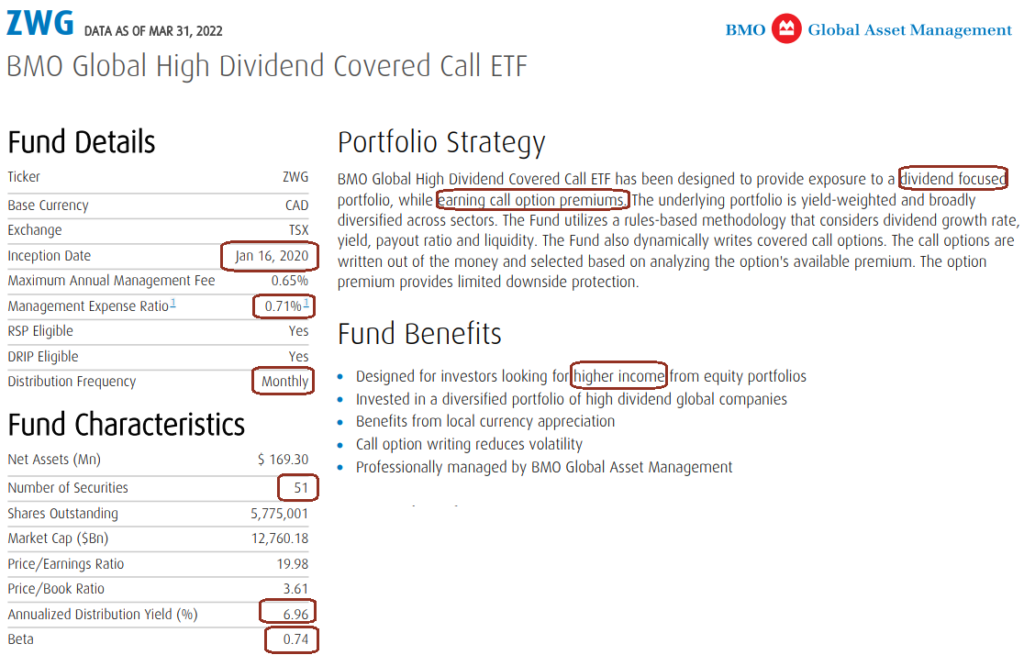

ZWG – BMO Global High Dividend Covered Call ETF

This is a relatively new covered call ETF that focuses on a wide variety of companies worldwide. It currently writes covered calls on around 50 stocks to produce a yield close to 7% and a low beta of 0.74. ZWG looks like a perfect fit for an investor looking for a high income and some stability (beta under 1).

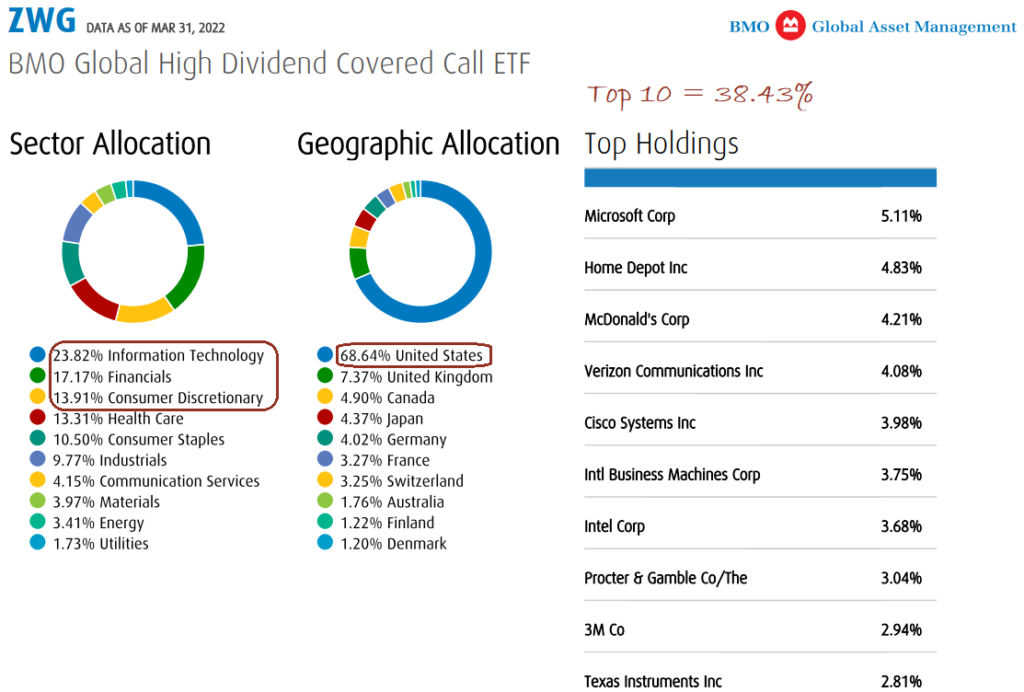

The first thing I look at when I analyze ETFs is the composition of the top ten holdings. I can rapidly identify if I want to invest in the ETF’s favorite companies. For BMO Global High Dividend Covered Call ETF, the top ten represent 38% of all holdings. You can find big names such as Microsoft (MSFT), Home Depot (HD), and McDonald’s (MCD).

ZWG is geared to generate growth and perform during a bull market with a concentration in information technology (24%), financials (17%), and consumer discretionary (14%) sectors. With 70% of U.S. exposure, it’s not as diversified as expected.

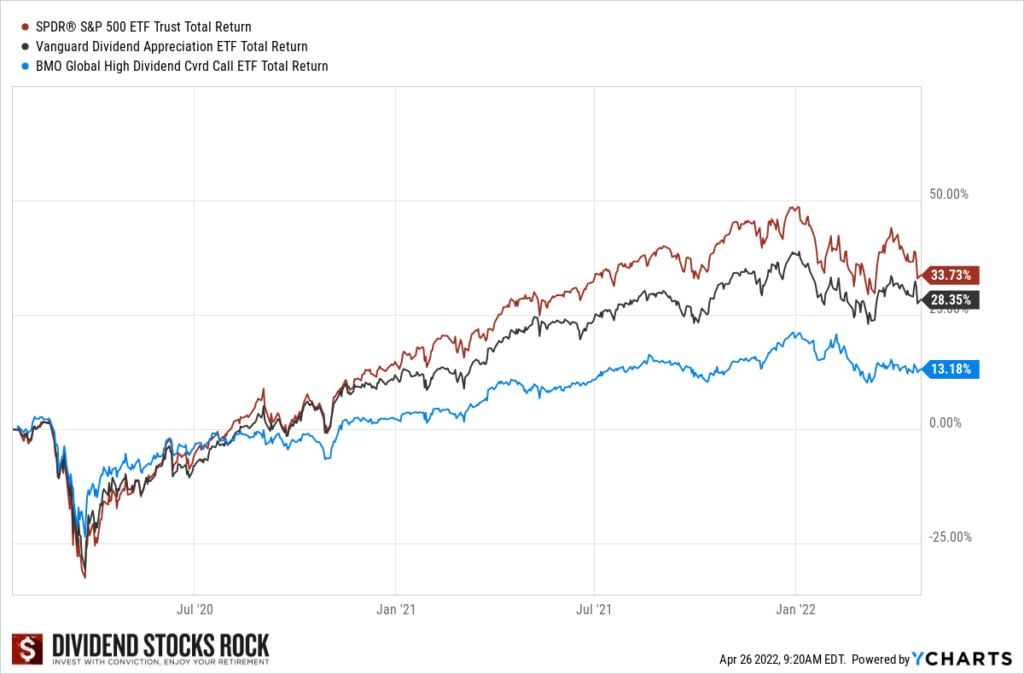

We wanted to compare the BMO Global High Dividend Covered Call ETF total return against the Vanguard Dividend Appreciation ETF (VIG) and an S&P 500 ETF (SPY). We want to see if it was worth it to invest in a covered call ETF instead of following a dividend growth investing strategy or simply buying an index. While the covered call ETF is underperforming the other two investment strategies, results aren’t meaningful considering ZWG was created in January 2020.

Let’s move to a covered call ETF that was created in 2017…

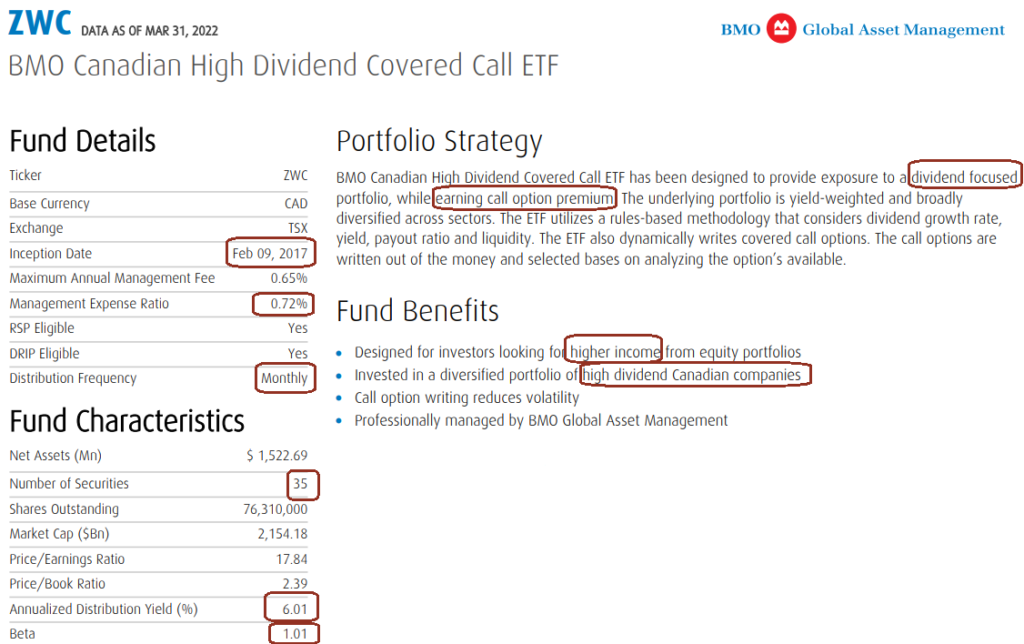

ZWC – BMO Canadian High Dividend Covered Call ETF

The Canadian high dividend covered call ETF is similar to the Global High Dividend Covered Call ETF, but it has a more extended history and focuses on Canadian equities. The yield is lower (6%), but you avoid currency fluctuations since all money is invested in Canadian equities. ZWC also pays a monthly dividend and shows similar management fees (around 0.72%).

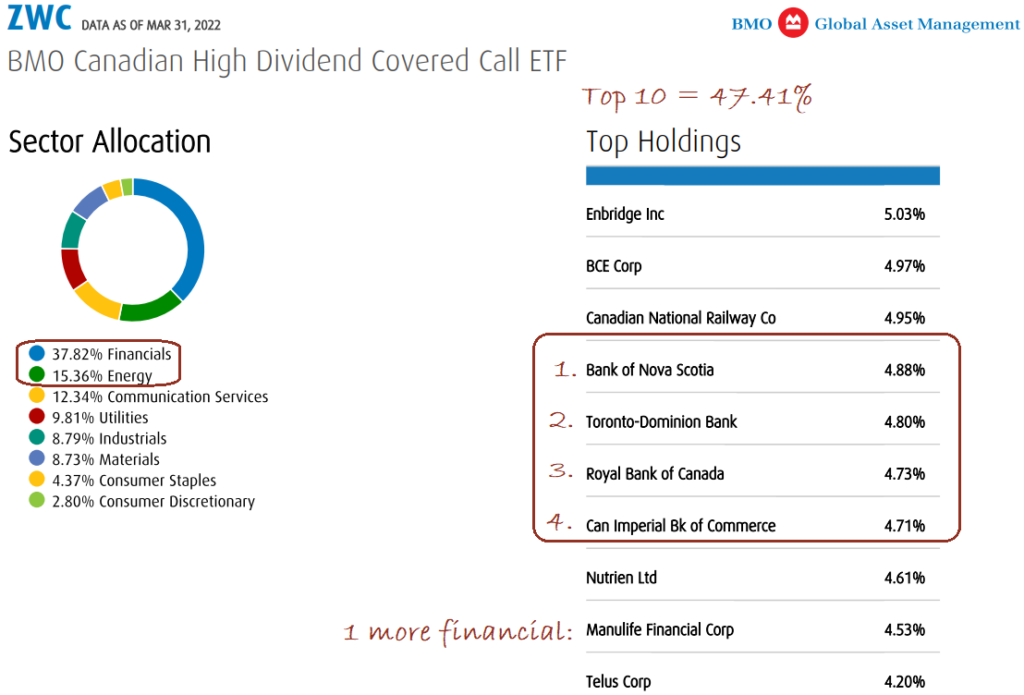

Out of 35 positions, the top ten represent 47% of ZWC. Unfortunately, this covered call ETF composition looks a lot like the TSX. There is a strong concentration in the financials (38%) and energy (15%) sectors. You will find 4 Canadian banks and a life insurance company among the top ten. This portfolio would be very easy to replicate in your brokerage account if it wasn’t for the covered call option strategy.

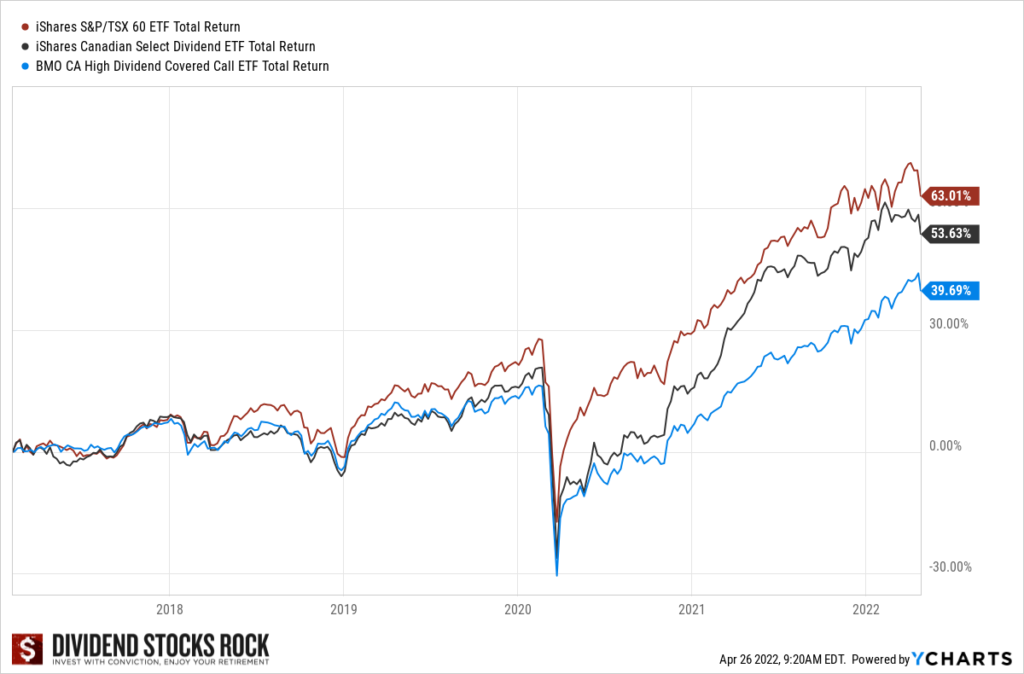

We used the iShares Canadian select dividend ETF (XDV.TO) and a TSX index ETF (XIU.TO) to see how the BMO Canadian High Dividend Covered Call ETF fares against other strategies. This time, we had a better time horizon (around 5 years). However, the conclusion is the same: the covered call ETF underperforms both dividend investing and index investing strategies.

Now, let’s move on to Canadian’s favorite covered call ETF: ZWB – BMO Covered Call Canadian Banks ETF!

ZWB – BMO Covered Call Canadian Banks ETF

This covered call ETF is pretty straightforward: it writes call options on the big six Canadian banks. We like that this ETF exist since 2011 as it gives us a long history to study. The management fees are similar to the other two covered call ETF (0.72%) and ZWB provides a yield of 6% with a beta in line with the market (1.00). You’ll notice the etf includes seven holdings…

The most important position of the BMO Covered Call Canadian Banks ETF is… another ETF! The BMO Equal Weight Banks Index (ZEB.TO) represents about a quarter of the total holdings. You then find the bix six:

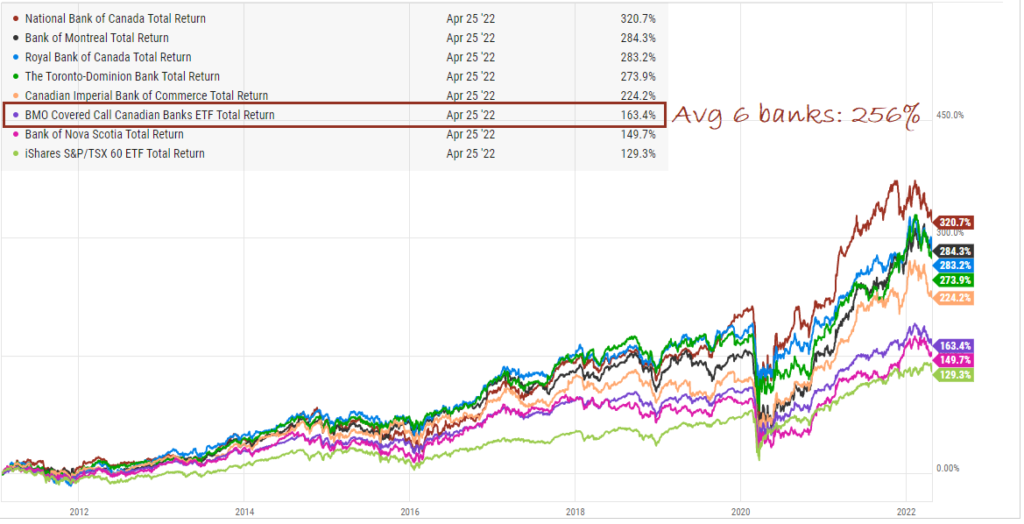

Since Canadian banks tend to outperform the market due to their unique position in an oligopoly and the ETF is relatively simple (it includes only six companies), we thought of comparing ZWB to the investment return of each of the big six. Surprisingly, the covered call strategy greatly underperforms the average return from the six banks. The covered call ETF generated a total return (capital + dividend) of 163% during the period, while the average performance of the six banks reported 256% on average. Unless you are a big fan of ScotiaBank (149%), you would have done better if you had selected any other banks vs. the ETF!

Final Though

We can appreciate the interest in high-yielding investment products. Covered call ETFs provide a monthly source of income, and their yield is way above what the market offers.

However, keep in mind that you leave a lot of money on the table if you choose covered call ETFs instead of investing directly in the companies’ stocks.